How can retailers balance omnichannel strategies with consumer preferences for physical stores?

Less than half of APAC consumers prefer online shopping, but most still rely on brick-and-mortar outlets.

Consumers in Asia Pacific show varied preferences for shopping, with a significant reliance on physical stores despite the rise of online retail. Retailers face the challenge of integrating digital technologies with traditional methods to cater to these diverse needs.

According to KPMG and GS1’s 'Navigating the Future of Seamless Commerce in Asia Pacific' report, only a small percentage of consumers can rely solely on online shopping, emphasising the ongoing importance of physical retail.

For instance, in Indonesia, just 8% of consumers expressed confidence in relying solely on online shopping, likely due to advancements in delivery services despite the country's geographical challenges. In contrast, only 1% of Filipinos and 2% of Singaporeans reported they could do without physical stores, underscoring the enduring preference for physical shopping experiences.

Preferred channels

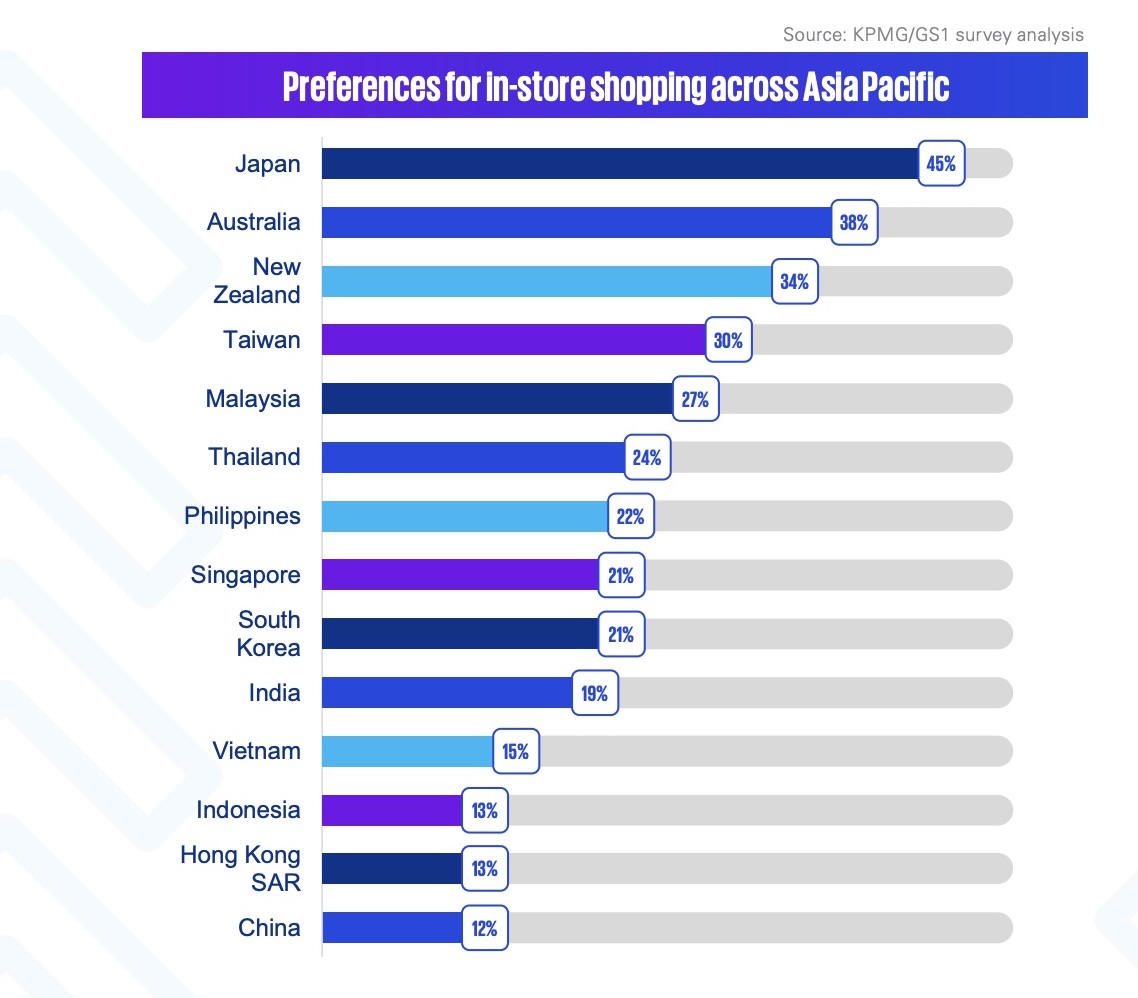

Consumer preferences vary significantly across Asia Pacific. About 45% of respondents selected omnichannel as their preferred purchasing channel, with the Philippines and India exhibiting the highest preferences at 61% and 54%, respectively.

Online shopping gained traction in markets like Hong Kong SAR, China, Vietnam, Indonesia, Singapore, and Taiwan. Conversely, consumers in New Zealand, Australia, Malaysia, South Korea, the Philippines, and Thailand still preferred physical stores.

Meanwhile, Japan preferred physical stores over omnichannel, whilst Indonesia showed a preference for online shopping over omnichannel.

The report said factors such as geographical spread, delivery efficiencies, and consumer habits influence these preferences.

“Although the COVID-19 pandemic accelerated online shopping across the Asia Pacific region, our survey reveals that consumer habits in terms of how, where, and when they shop remain highly varied,” it stated.

Market growth

Data from Forrester showed that in the Asia Pacific region, top countries, including China, South Korea, Japan, India, and Australia are expected to see online retail sales grow from $2.2t in 2023 to $3.2t in 2028. China leads this surge, with both China and South Korea expected to exceed 40% online retail penetration by 2028.

Globally, online retail sales are anticipated to reach $6.8t by 2028, with a compound annual growth rate of 8.9% from 2023's $4.4t. However, the report stressed that despite this growth, 76% of global retail sales are expected to remain offline in 2028, totalling $21.9t.

Seamless commerce and retail strategy

Seamless commerce has now become the new standard, leaving traditional retail models trailing behind in meeting consumer demands, the KPMG and GS1 report said.

The pandemic accelerated this transformation, prompting retailers to heavily invest in technology and streamline supply chains to cater to digitally savvy consumers.

“Not only did they head online to purchase food, groceries and other essential goods, but the migration from working in offices to working from home saw demand in categories like apparel and home furnishings as they required more casual wear and home-office equipment,” the report stated.

This surge in online activity, coupled with increased social media use, compelled businesses to invest in technology for better customer engagement, personalised product recommendations, and efficient supply chain management to ensure faster deliveries and improved inventory management.

Regionally, e-commerce platforms showed significant variation, with dominant players such as Amazon holding sway in markets like India, Japan, and Hong Kong SAR. Social commerce and live streaming are also emerging as the fastest-growing trends in several Southeast Asian markets.

Intense competition amongst various e-commerce solutions and marketplaces prevails in the Asia Pacific region, as consumers prioritise platforms offering extensive product ranges and reliable delivery. Competitive pricing, promotions, swift delivery, and enhanced customer service are amongst the critical factors driving these consumer choices.

Questions to consider:

- What strategies can retailers employ to overcome geographical challenges and enhance delivery services for online shoppers?

- What investments are retailers making in technology to support the transition towards seamless commerce?

Advertise

Advertise