Blind boxes spur collectible toy growth in Asia-Pacific market

Consumers keep buying more until they get their desired product.

Collectible toy companies like Funko and Pop Mart are driving market growth through blind boxes — a trend characterised by buyers not knowing which products they will get upon purchase.

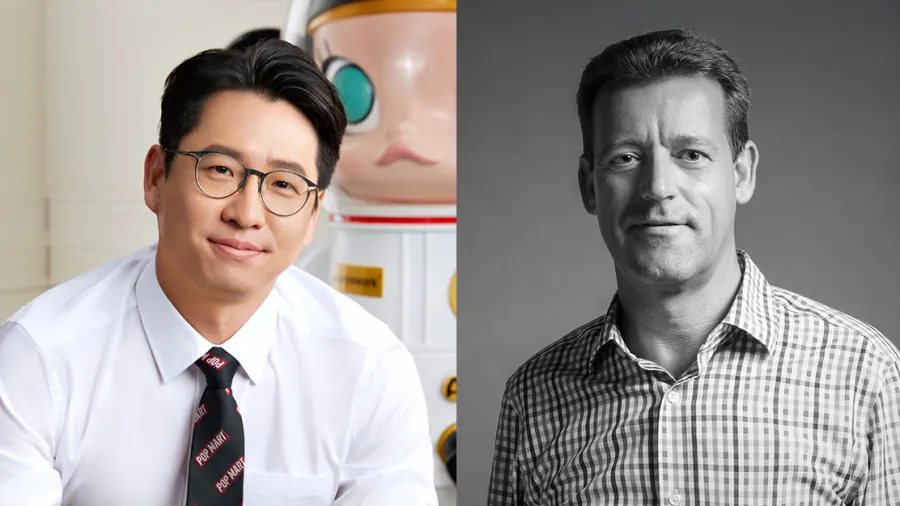

The element of surprise drives customers to buy more, Andy Clempson, vice president for sales in the Asia-Pacific region at US-based Funko, told Retail Asia. “It keeps consumers loyal and coming back to purchase until they get their desired product.”

Clempson said the micro-collectible segment of blind boxes that includes spin-offs of the same product made up roughly 10% of the market last year, growing 35% from a year earlier.

The global collectible market size was estimated at $294.2 billion in 2023 and is projected to grow 5.5% annually until 2030, according to Grand View Research.

Also capitalising on the “blind” strategy is Chinese toy company Pop Mart with its Labubu bag charm product line. In 2019, the company worked with Belgium-based artist Kasing Lung to launch the product, which is based on the furry elf character from his story series “The Monsters.”

Since then, Pop Mart has released several Labubu spin-offs, attracting global attention. Revenue from international markets hit $1.9b (RMB13.5b), accounting for 29.7% of total sales in the first half of 2024.

Justin Moon, president at Pop Mart International, said collaborating with global designers ensured the success of Labubu. He said the company localises its products by blending these with cultural elements.

Some examples are the Merlion Labubu vinyl plush, Taiwan’s bubble tea mega space Molly figurine, and a UK-exclusive Pop Bean football Labubu.

Clempson said the Philippines holds the biggest market share at Funko. “What we did was release a Jollibee Funko Pop, appealing to its widespread cultural significance in the Philippines.”

Clempson said strategic collaborations are also key to the growing popularity of collectibles in the Asia-Pacific region. Funko has more than 1,100 licenses with brands such as Disney, Warner Brothers, Universal, and Netflix.

“We try to keep ahead by identifying who we can partner with faster than anyone else,” he said. “Every month, we present to our distribution partners 100 new lines, which allow them to bring freshness and newness to the market.”

Both Funko and Pop Mart expect the industry to continue growing in the coming years, driven by tech advancements, the push for sustainability, and more product lines.

Advertise

Advertise