Foodpanda automates ‘dark stores’ in Singapore to speed up deliveries

Its 24/7 warehouses ensure round-the-clock fulfilment.

Foodpanda is automating its storage and retrieval system at its retail warehouses and using robots and artificial intelligence to optimise demand forecasting, inventory management, and order processing in Singapore.

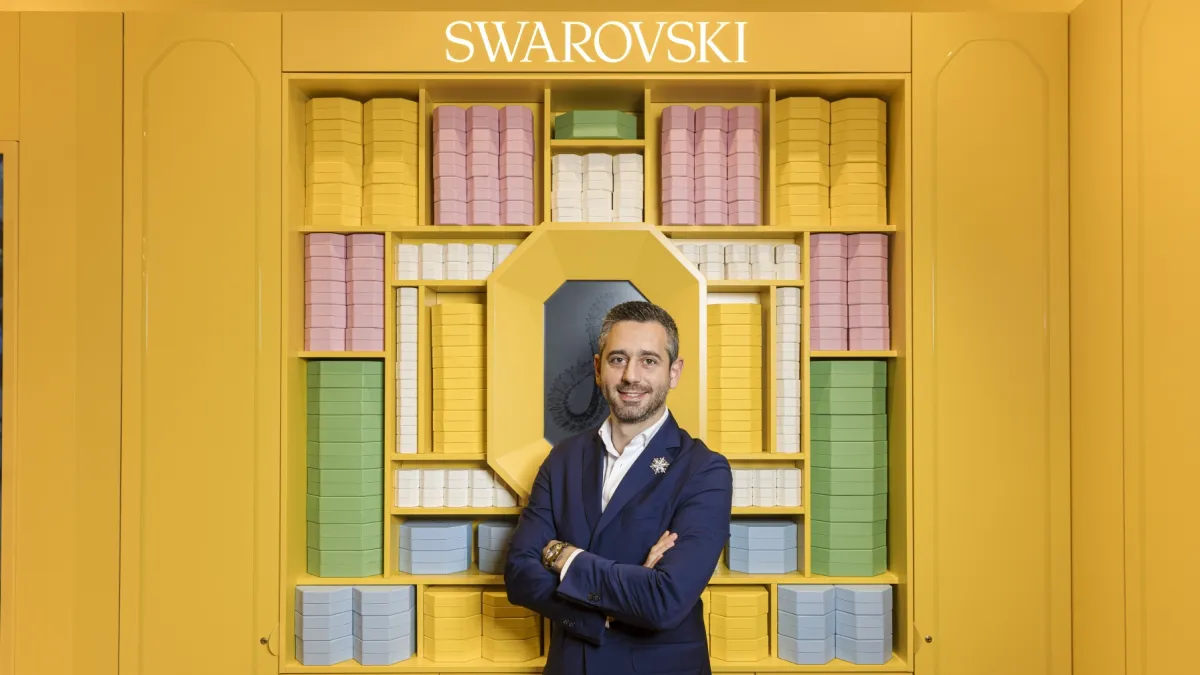

“Technology and data intelligence allow us to enhance the experience for our customers, merchants, and delivery partners, whilst improving the efficiency of internal operating processes,” Kevin Zagolin, director of quick commerce at Foodpanda, told Retail Asia.

Pandamart, Foodpanda’s cloud grocery store, operates as a network of micro-fulfilment centres, supporting on-demand delivery of groceries and household essentials. The company uses data insights to stock each cloud store with inventory tailored to the local demand, Zagolin said in an emailed reply to questions.

“For example, if a particular product category, like certain vegetables in certain zones, sees high demand in a specific city, Pandamart adjusts both the assortment and quantity of inventory in that location to ensure availability and better meet customer needs,” he said.

Location intelligence and demand trends also guide the placement of Pandamart facilities. In Singapore, some cloud stores now stock more than 5,000 unique products to cater to the diversity of customer preferences, he added.

Foodpanda analyses customer behaviour on its app and offers targeted discounts based on browsing and buying habits.

Whilst automation optimises inventory selection, warehouse layout, and order picking, humans ensure quality control, particularly for fresh produce. Staff inspect fresh items, minimise waste, and handle damaged goods or special customer requests.

Since Foodpanda owns its own inventory, procurement is faster and key products, including meats and vegetables, are always available. Its 24/7 warehouses ensure round-the-clock fulfilment.

Singapore’s online grocery market, valued at $1.1b in 2024, is projected to grow 8% annually in the next eight years, according to market research firm The Report Cube. This growth presents challenges in delivering larger basket sizes quickly and reliably, Zagolin said.

“We are adapting our fleet to support this shift,” he said. This includes adding cars and vans to complement its existing two-wheeler network.

Foodpanda has also expanded its retail marketplace, Foodpanda shops, partnering with more than 200 major retailers across Asia. These include DFI Retail Group in Singapore, Robinsons Easymart in the Philippines, and Giant Mini in Malaysia.

The bill size for quick-commerce orders across Asia jumped over 50% from 2021 to 2023, driven by customers ordering more frequently and buying more items per order.

“As we expand our quick-commerce offerings, our focus is on making grocery delivery as big as food delivery,” Zagolin said.

Advertise

Advertise