Are emotional loyalty strategies more effective than transactional approaches?

One in three customers in APAC join loyalty programs to build lasting connections.

Retailers may now retire the red signs promoting discounts and point-based rewards. Whilst initially effective, these tactics have saturated the marketplace with similar loyalty programmes, ultimately making consumers more likely to switch brands and undermining long-term loyalty. This shift from transactional to emotional strategies now dominates, focusing on building deeper connections with customers.

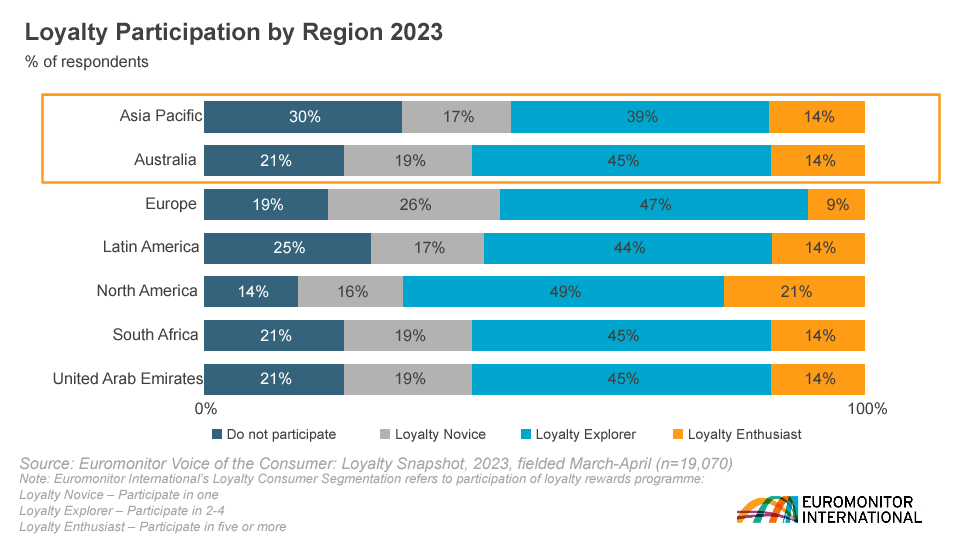

According to Euromonitor International’s Voice of the Consumer: Loyalty Survey, over half of Asia Pacific consumers are members of more than one loyalty programme, complicating the redemption and management of accrued rewards.

This trend underscores consumer preferences for maximising benefits across various daily spending categories and the challenge companies face in managing points liability, a potential drain on profitability in transaction-focused loyalty models.

Conversely, a growing trend towards emotional loyalty strategies offers a potential solution, promising enhanced customer retention through deeper and non-monetary connections.

Nearly one in three consumers in the region join loyalty programs to forge lasting connections with beloved brands, a sentiment surpassing the global average, the report noted.

“Emotional loyalty strategies, such as personalisation and building brand communities, are efficient ways to elevate relationships with customers utilising existing resources” it added.

In Hong Kong, nearly half of consumers also prefer actively engaging with brands, emphasising the importance of companies prioritising emotional loyalty.

Prudence Lai, a senior analyst at Euromonitor International, highlighted a growing desire for authentic and personalised connections with brands, driven by a preference for unique experiences.

She said that consumers join loyalty programmes that offer rewards “just for being a customer,” solve problems, and express gratitude.

“This shows that customers with a strong interest in engaging with brands through joining loyalty programmes are searching for more personalised and emotional connections,” Lai told Hong Kong Business.

Innovative strategies leveraging emotional loyalty tactics, seen in success stories like Rakuten Point and Adidas Group in Asia Pacific, have also driven higher redemption rates and increased consumer engagement.

These strategies include personalised incentives, gamification, and exclusive experiential rewards aimed at enhancing customer loyalty beyond mere transactional benefits.

Transactional strategies

However, the report also noted that about 60% of consumers in the Asia Pacific region engage in loyalty programmes primarily to secure discounts or special offers.

This consumer behaviour drives aggressive competition amongst companies in markets like Japan, Korea, and Hong Kong. This led to the establishment of proprietary loyalty ecosystems, exemplified by Asia Miles by Cathay Pacific, Rakuten Point by Rakuten Group, and L.Point by Lotte Group.

In Australia, Myer's MYER One program has enhanced customer engagement and increased sales.It has strengthened the initiative through partnerships with American Express, Commonwealth Bank, and Virgin's Velocity program. Out of 7.3 million members, 4.2 million were active in 2022/23, with nearly 75% of Myer's purchases linked to MYER One accounts.

Similar approaches are also being embraced by Big W and Woolworths, which offer members-only discounts to encourage card usage.

In sectors like food delivery in India, firms like Swiggy have innovated by launching Swiggy One Lite, a more affordable loyalty program introduced in October 2023. It offers 10 free food and Instamart deliveries and a 30% discount at over 20,000 restaurants across India, effectively attracting a larger customer base.

Moreover, health and beauty retailers in the Philippines are creatively using loyalty programmes to drive consumer purchases, as evidenced by Watsons Club’s Live Well Get Rewarded campaign in September 2023. This encourages wellness choices amongst members with benefits such as 5% discounts on vitamins and supplements, and 10% off Watsons brand products.

The programme also includes partnerships with 50 merchants across wellness, food, travel, and leisure sectors, offering special discounts from various partners to enhance consumer engagement.

Loyalty market growth

The loyalty market in Asia-Pacific is anticipated to grow at 11.0% annually, reaching $52.05b by 2024, according to ResearchAndMarkets.com’s report. From 2019 to 2023, the market grew at a 12.6% CAGR, and it's projected to continue expanding at a 9.6% CAGR from 2024 to 2028, hitting $75.02b.

Globally, breakage rates in loyalty programmes hover around 15%, posing a significant financial burden across industries reliant on loyalty programmes. One example is Cathay Pacific's flagship loyalty initiative which contributes to 33% of its current liability.

This growth trend supported by initiatives, like personalised offers driven by data analytics, spans various sectors from India to Australia and Japan.

Customer loyalty varies across different sectors like apparel, food & grocery, electricals, health & beauty, and home, GlobalData’s ‘Customer Loyalty in Retail and Apparel’ thematic intelligence report said.

In the apparel sector, loyalty is crucial due to market saturation and the ease of switching between brands. Retailers can build loyalty through social media engagement and events, especially by aligning with Gen Z values on sustainability and ethics.

Meanwhile, the home sector experiences lower customer loyalty due to the infrequent nature of purchases, such as furniture and floor coverings, resulting in lower overall loyalty levels.

Questions to consider:

1. Should brands focus on building emotional connections rather than offering transactional perks to enhance customer loyalty?

2. How can brands balance emotional and transactional elements in loyalty programmes to maximise retention and engagement?

Advertise

Advertise