Consolidation in the cards for retailers and suppliers

Suppliers may even soon become competitors with retailers in the e-commerce space.

Retail and supply chain companies across Asia Pacific could look towards consolidation to streamline production and distribution, with larger manufacturing companies with strong e-commerce positions that focus on essential goods or well-performing brands are more likely to do so as part of cost-saving initiatives, according to logistics firm C.H. Robinson.

“Given the current economic landscape, it is possible that we will see smaller players become potential acquisitions for more resilient competitors such as e-commerce shopping platforms,” C.H. Robinson’s director of ecommerce Asia, Phil Teng, shared in an interview with Retail Asia.

Companies can view consolidation as a strategic way to build competitive advantages through improving the value chain, acquiring critical capabilities, and forming strong alliances, he added.

If not properly regulated, market consolidation could potentially lead to limited supply and less attractive rates. However, it could also bring about positive outcomes, such as greater geographic reach. Further, larger retailers might also gain critical capabilities such as real-time logistics tracking technology, better online selling platforms, and last-mile strategic tools such as Internet of Things (IoT) and sensors.

“Ultimately, these consolidation activities aim to better address customer needs—which can also result from collaborations with logistics providers,” Teng noted.

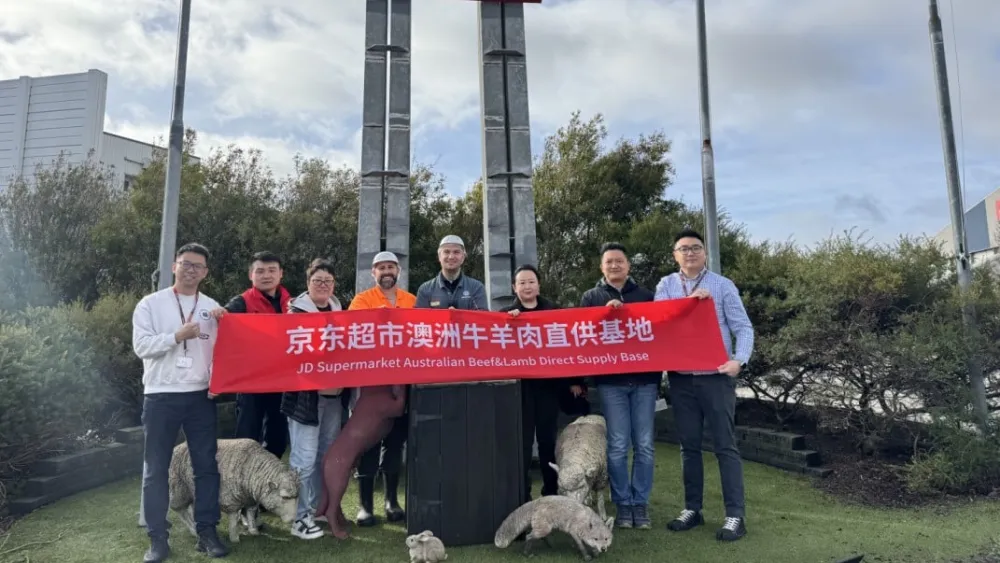

C.H. Robinson has observed traditional business-to-business (B2B) manufacturers venture into the business-to-consumer (B2C) space by selling their products on e-commerce platforms. Teng noted: “In view of this, retailers should take heed that their suppliers may soon become their competitors in both spaces as well.”

Furthermore, demand volatility is expected to continue to cause issues for business planning in the next six to 12 months. Teng shared that their customers continue to share that they have been struggling to place new orders as they are unable to make accurate demand forecasts. This is largely due to uncontrollable external factors – such as consumer demand and supplier availability.

However, there is still an opportunity for retailers to leverage their data to gain valuable insights into the market. In particular, technology that allows for real-time information and predictive analytics solutions is expected to help retailers in the foreseeable future. Businesses could also heavily invest in securing online customer traffic as well.

“We can expect more investments in cutting-edge data tools and business intelligence solutions, as well as a growing reliance on cloud computing and the Internet of Things solutions as part of an industry-wide transformation for the retail business,” Teng said.

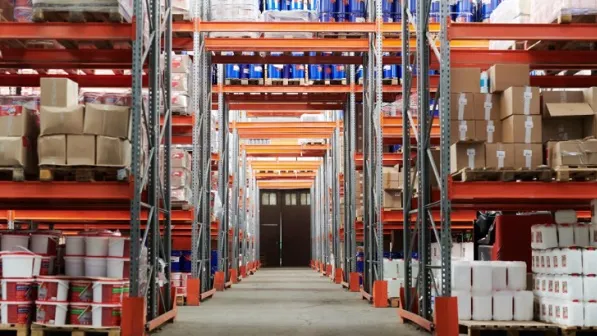

The modern supply chain has faced several recent challenges, ranging from transit uncertainty to the consolidation of service providers to trade war-related considerations. The pandemic has caused a surge in online sales, and KPMG estimated that online retailing could reach 50% of the total goods purchased by 2025, five years earlier than previously anticipated.

In ASEAN, this has been observed from e-commerce platforms Lazada and Shopee, which have been expediting their logistics constructions within key markets such as Thailand and Indonesia.

With the stiff competition due to globalisation and the rising e-commerce landscape in Asia, Teng noted that there has been higher demand for retail logistics services. “Today, a single retailer may rely on a network of suppliers and partners located across the globe; however, ensuring their evolving logistic needs are met is no easy feat,” he said.

The surge in online purchases is expected to continue even after countries relax lockdown restrictions, and e-commerce will thus play a larger role in the so-called ‘new normal’. With this, retailers and logistics players were urged to change the way they operate, from forecasting market movements to managing inventories.

“The static, operational logistics model – characterised by heavy reliance on single supplier sources and the assumption of always-available raw materials – is no longer viable. COVID-19 has taught companies a valuable lesson: the importance of a dynamic supply chain model, fortified by diverse production facilities and back-up local sources of supply in key consumer markets,” Teng said.

Advertise

Advertise