Traceable, regenerative, profitable: The new rules of food retail in Asia

By Gareth LloydFor today’s shopper, traceability is not a nice-to-have—it’s a deal-breaker.

Across Asia, retail is waking up to a powerful reality: sustainability is no longer a marketing tool. It is fast becoming a core operating principle—and a business imperative.

In markets like Singapore, Vietnam and Indonesia, sustainability is rising up the boardroom agenda, driven by increasingly conscious consumers, investor scrutiny, and emerging regulation. Retailers and brands that once dabbled in eco-friendly campaigns or token initiatives now face a different climate—one that demands measurable action, transparent sourcing, and long-term commitment.

Retailers are moving beyond paper bags and recyclable logos and shifting their focus to supply chain transparency, ESG governance, and partnerships with purpose. This transition is being driven not by optics, but by clear consumer expectations and commercial priorities.

A Nielsen global survey found that 81% of consumers believe companies should help improve the environment—with Southeast Asia showing some of the highest concern. Meanwhile, research from IBM and the National Retail Federation revealed that nearly 70% of global consumers are willing to pay a premium for brands offering full transparency and traceability.

A new baseline for doing business

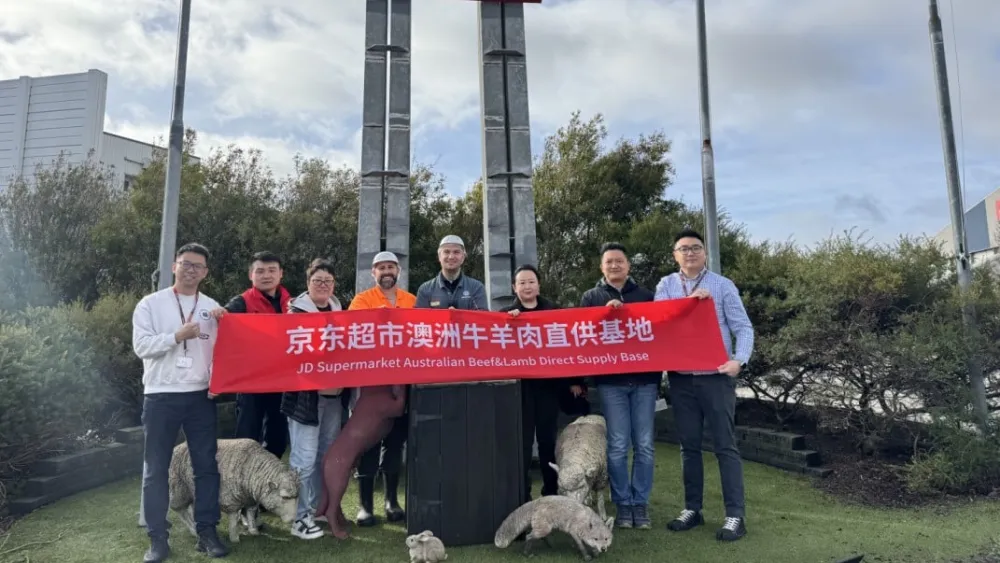

These expectations are already reshaping supply chains. Across Indonesia, Thailand and Vietnam, producers are turning to blockchain and other digital solutions to verify the origin of palm oil, seafood, and viscose. Many of these initiatives are backed by ESG-linked financing or tied to export requirements—making traceability a new baseline for doing business.

This is particularly true in food retail. Regenerative agriculture—once seen as niche—is gaining momentum across Southeast Asia. Farmers in countries like Thailand and the Philippines are piloting practices that restore soil health, improve water retention, and reduce carbon emissions. Globally, the regenerative agriculture market is projected to grow from $920m in 2022 to $3.25b by 2030, expanding at nearly 15% per year. The commercial case is clear: sustainability isn’t just ethical—it’s scalable.

Even more remote examples are gaining traction. Take nut farming, for instance. In parts of the Amazon, the harvesting of wild Brazil nuts—done by hand, without cutting down trees—helps protect rainforest ecosystems and prevent deforestation. When retailers support sourcing models like these, the environmental impact is tangible: a living forest is preserved, biodiversity is maintained, and rural livelihoods are supported. But these benefits only matter if they’re traceable and transparent.

Authenticity has become currency

This shift underscores an essential truth: authenticity is now currency. In the eyes of consumers, retailers are being judged not on how green they appear, but on how responsible they are—end-to-end. Investors, too, are asking harder questions. How credible are a brand’s sustainability claims? Can these models scale without unintended consequences? Are governance practices in place to ensure long-term accountability?

As retail networks grow across Asia, there’s a risk of sustainability being siloed into compliance or communications teams.

Yet the most resilient brands are those embedding environmental, social, and governance (ESG) goals into their governance structures—appointing senior-level champions, linking key performance indicators to sustainability outcomes, and making ESG a core part of strategy rather than an afterthought.

That means aligning leadership, company culture, and daily operations around a clear environmental and social ethos. From sourcing and logistics to packaging and pricing, every business function has a role to play.

A growing number of retailers in Asia are integrating sustainability into their expansion plans—not just to meet regulations, but to win trust, drive innovation, and create long-term value.

New metrics of success

Consumers, particularly Gen Z, are demanding this kind of leadership. They are values-driven and digitally savvy, with a keen eye for authenticity.

They will reward brands that reflect their priorities: environmental stewardship, ethical sourcing, and community impact. And they’re not interested in half-measures. For today’s shopper, traceability is not a nice-to-have—it’s a deal-breaker.

Retailers looking to take meaningful steps should start by investing in technologies and partnerships that bring full transparency to their supply chains.

Collaborating with local producers, non-government organisations, and cooperatives can help pilot more sustainable sourcing models that scale over time. And rather than creating siloed sustainability programmes, brands should weave ESG goals directly into their growth strategy, guided by leadership at the very top.

The future of retail in Asia will be shaped not by who can talk the best game—but by who can prove real-world impact.

Forests protected, emissions reduced, incomes raised, and waste eliminated. These are the new metrics of success.

The question is no longer “How do we look more sustainable?” It’s “What impact are we actually making?” That’s what will matter most to tomorrow’s consumers—and today’s business performance.

Advertise

Advertise