Japan sentiment rises 16% but splurge intent still limited

Only 30% plan discretionary spending, McKinsey data shows.

Japan’s consumer net sentiment rose to 16% in Q4 2025, its highest level since the pandemic, although spending intentions remain cautious, according to McKinsey’s Asia-Pacific consumer sentiment survey.

McKinsey said pessimism amongst Japanese consumers declined by 10 percentage points from the previous quarter, contributing to the improvement in sentiment. Despite this, Japan’s overall net sentiment remains lower than most Asia-Pacific markets covered in the survey.

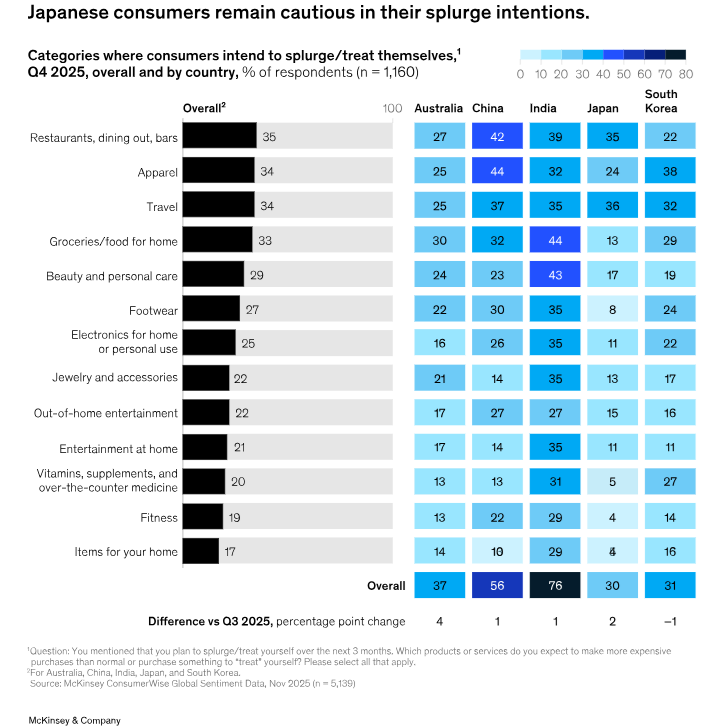

Data from McKinsey’s ConsumerWise Global Sentiment survey showed that only 30% of Japanese consumers planned to splurge or treat themselves over the next three months, compared with 56% in China and 76% in India. Travel was the most cited category in Japan at 36%, followed by dining out at 35% and apparel at 24%.

Spending intent was notably weaker in other discretionary categories, with only 13% planning higher grocery spending, 11% for electronics and 4% for fitness-related purchases, the survey showed. McKinsey said the findings highlight continued selectivity in Japanese consumer spending despite improving sentiment, based on responses from 1,160 Asia-Pacific consumers.

Advertise

Advertise