Mars Wrigley bertaruh akan booming cokelat di Asia

Perusahaan AS ini memperkirakan kelas menengah yang tumbuh di kawasan ini akan mengonsumsi lebih banyak M&M’s dan Snickers.

Mars Wrigley mengandalkan pertumbuhan kelas menengah di Asia — termasuk di Filipina, Vietnam, dan Indonesia — dalam upayanya untuk menggandakan pendapatan tahunan divisi camilan menjadi US$36 miliar dalam satu dekade ke depan.

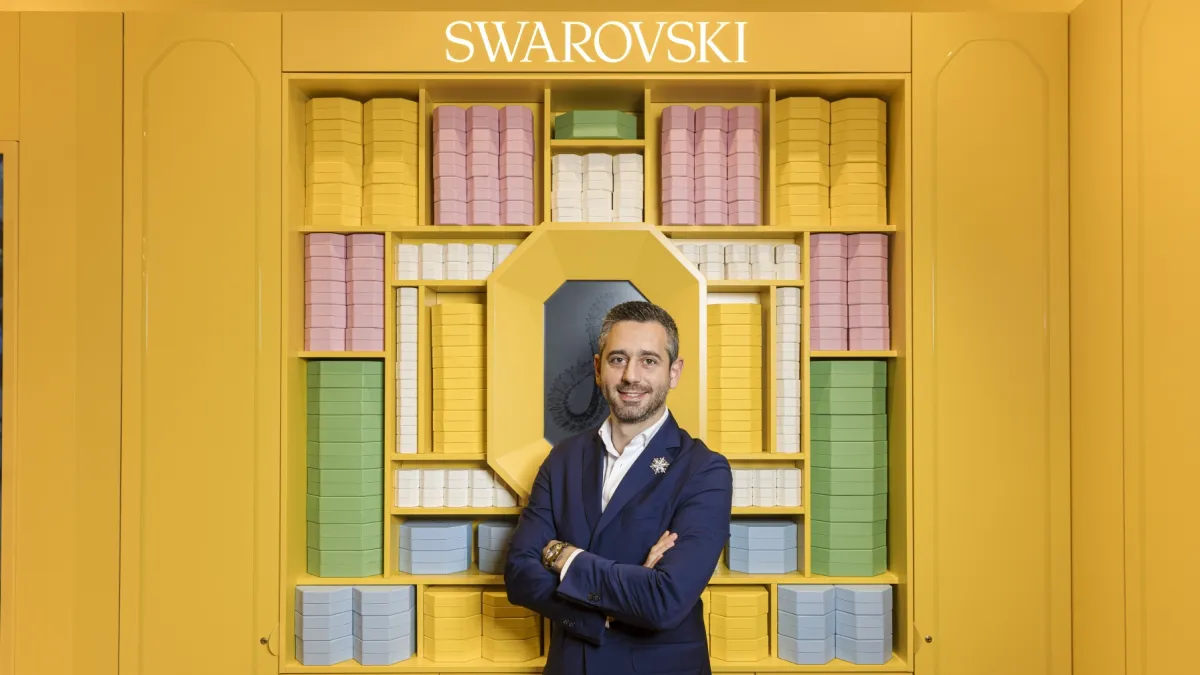

Produsen cokelat, permen karet, permen mint, dan permen buah terbesar di dunia ini tengah menyesuaikan diri dengan kebutuhan unik pasar Asia sebagai strategi utama, kata Kalpesh Parmar, General Manager Mars Wrigley Asia, kepada Retail Asia.

“Untuk sukses di Asia, kita harus mengakui bahwa tidak ada pendekatan yang seragam,” ujarnya. “Agar Mars berhasil, kami harus tetap sangat berfokus pada konsumen, dengan menyesuaikan strategi kami terhadap kebutuhan unik di setiap pasar.”

Sebagai contoh, perusahaan yang berbasis di AS ini — pembuat M&M’s, Snickers, Orbit, dan Skittles — telah memperkenalkan “smaller packs of happiness” di Asia Tenggara, di mana konsumsi cokelat masih lebih rendah dibandingkan dengan Eropa dan Amerika Utara.

Pasar permen di Asia diproyeksikan tumbuh sebesar 5,6% per tahun hingga mencapai US$213 miliar pada tahun 2029, menurut platform data daring asal Jerman, Statista. Sebagian besar dari pendapatan sebesar US$201,8 miliar di kawasan ini pada 2024 berasal dari Cina, yakni sebesar US$84 miliar.

Parmar menyebutkan pertumbuhan kelas menengah di Asia, di mana banyak di antaranya belum pernah merasakan brand-brand internasional. “Ada potensi besar bagi kami untuk meningkatkan penetrasi di pasar-pasar ini dan menjadikan brand kami dikenal luas oleh masyarakat.”

Dia mencatat bahwa Asia — yang merupakan rumah bagi 60% populasi dunia — menghadirkan peluang pertumbuhan yang signifikan bagi grup ini, yang produknya dinikmati di lebih dari 180 negara. Bisnis Mars Wrigley di Asia tersebar di 20 pasar (tidak termasuk Cina, Jepang, dan India), dengan Korea Selatan, Hong Kong, Taiwan, Malaysia, Thailand, Vietnam, Filipina, dan Indonesia sebagai pasar-pasar utama untuk pertumbuhan.

Seiring meningkatnya pendapatan yang dapat dibelanjakan, konsumen diperkirakan akan memperbesar ukuran keranjang belanja mereka, sehingga menjadi penting bagi Mars Wrigley untuk menawarkan produk yang sesuai dengan selera lokal.

“Penjualan kami sebagian besar didorong oleh kategori cokelat, permen buah, dan produk hewan peliharaan,” katanya. “Meskipun kondisi keuangan kami sehat, kami melihat peluang besar untuk memperluas pangsa pasar melalui strategi berbasis volume di seluruh kawasan.”

Parmar mengatakan bahwa pendekatan “right size, right price” mereka membuat produk cokelat mereka menarik bagi banyak orang.

Mars Wrigley juga menyesuaikan diri dengan meningkatnya kesadaran konsumen terhadap kesehatan. Lebih dari 58% masyarakat Asia mengutamakan kesehatan fisik dan emosional, mendorong perusahaan untuk memperkenalkan pilihan yang lebih sehat seperti cokelat hitam Snickers dengan setengah kadar gula dan batangan KIND dengan kurang dari 200 kalori, katanya.

Produsen cokelat ini juga mengandalkan e-commerce untuk mendorong pertumbuhan, ujar Parmar, dengan merujuk pada kemitraan bersama platform daring seperti FoodPanda, Grab, dan TikTok.

Meningkatnya transaksi digital turut membentuk ulang lanskap ritel di Asia, di mana 70% transaksi diperkirakan akan menjadi digital pada tahun 2027. “Hal ini mendorong kami untuk terus berinovasi dalam proses digitalisasi bisnis kami. Kami melihat ini sebagai peluang pertumbuhan dan sepenuhnya merangkul masa depan digital,” kata Parmar.

Saluran pengiriman cepat juga menjadi semakin penting, terutama di pasar-pasar di mana jalur pembelian impulsif tradisional kurang berkembang. Saluran ritel tradisional pun telah menyesuaikan diri dengan era digital dengan berfungsi sebagai titik pengambilan untuk pesanan daring, ia menambahkan.

Mars Wrigley berencana untuk menginvestasikan kembali lebih dari 90% laba mereka ke dalam bisnis, seiring dengan upaya mereka untuk terus meningkatkan kualitas produk dan keberlanjutan, tambahnya.

Advertise

Advertise