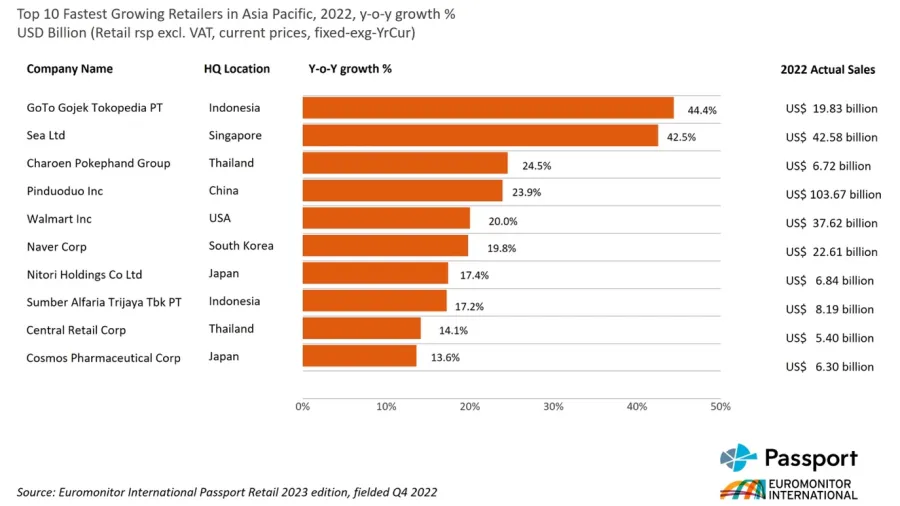

Here are the top 10 fastest-growing APAC retailers

Indonesia’s GoTo Gojek Tokopedia PT and Singapore’s Sea Ltd. are taking the lead.

Indonesia-based GoTo Gojek Tokopedia PT is the fastest-growing retailer in the Asia Pacific (APAC) after recording a retail sales growth of 44.4% year-on-year (YoY) reaching $19.83b in 2022, according to a report by Euromonitor International.

Coming in second is the e-commerce powerhouse Sea Limited, owner of Shoppee, which saw a 42.5% growth in sales reaching $42.58b.

Euromonitor said Shopee’s hyperlocalisation, competitive pricing, and extensive product range, along with various features such as livestreaming and interactive games were the main drivers of the e-commerce business’s consumer engagement.

Other companies that made it into the top 10 were Thailand’s Charoen Pokephand Group, China’s Pinduoduo Inc., USA’s Walmart Inc., South Korea’s Naver Corp., Japan’s Nitori Holdings Co Ltd., Indonesia’s Sumber Alfaria Trijaya Tbk PT., Thailand’s Central Retail Corp., and Japan’s Cosmos Pharmaceutical Corp.

ALSO READ: What drives APAC Gen Zs consumer behaviour

APAC’s retail e-commerce sales continue to post strong growth due to digitalisation and continued consumer habits.

“Differing strategic priorities and initiatives in the Asia Pacific have provided the e-commerce market with unique growth opportunities; Social e-commerce thrives in the future retail market as a powerful tool for retailers to engage consumers,” Euromonitor said.

Social commerce will exceed the livestreaming e-commerce market by 2026 to reach over $300b due to the increased social media use which provides a “conducive environment” for social e-commerce growth.

Meanwhile, China saw a 4% decline in retail offline sales in absolute dollar terms due to the strict lockdown policies, whilst other markets such as India, Indonesia, and South Korea recorded strong growth.

Euromonitor said that the growth supported various retail channels, especially apparel and footwear specialists, beauty specialists, and vending due to the resumption of international travel and the lifting of lockdown restrictions.

Advertise

Advertise