How can retailers scale gen AI?

Only two of 52 Fortune 500 retail companies have fully unlocked the technology’s value.

Generative artificial intelligence (gen AI) is poised to unlock as much as $390b in economic value for retailers, according to a McKinsey & Co. report released this month, though few Fortune 500 retail executives have successfully integrated the technology in their organisations.

“This, combined with the value of nongenerative AI and analytics, could turn billions of dollars in value into trillions,” according to the consulting firm.

Despite extensive testing and pilot programs, only two of 52 global retailers surveyed by McKinsey have managed to realise gen AI’s full potential at scale. Key challenges to widespread adoption include the need for organisational change, data quality and privacy concerns, and high implementation costs.

Retailers can increase their revenue by as much as 10% through a suite of personalisation initiatives including shopping assistants, enhanced search, and localised recommendations, according to a global study by Tokyo-based ad agency Dentsu, Inc.

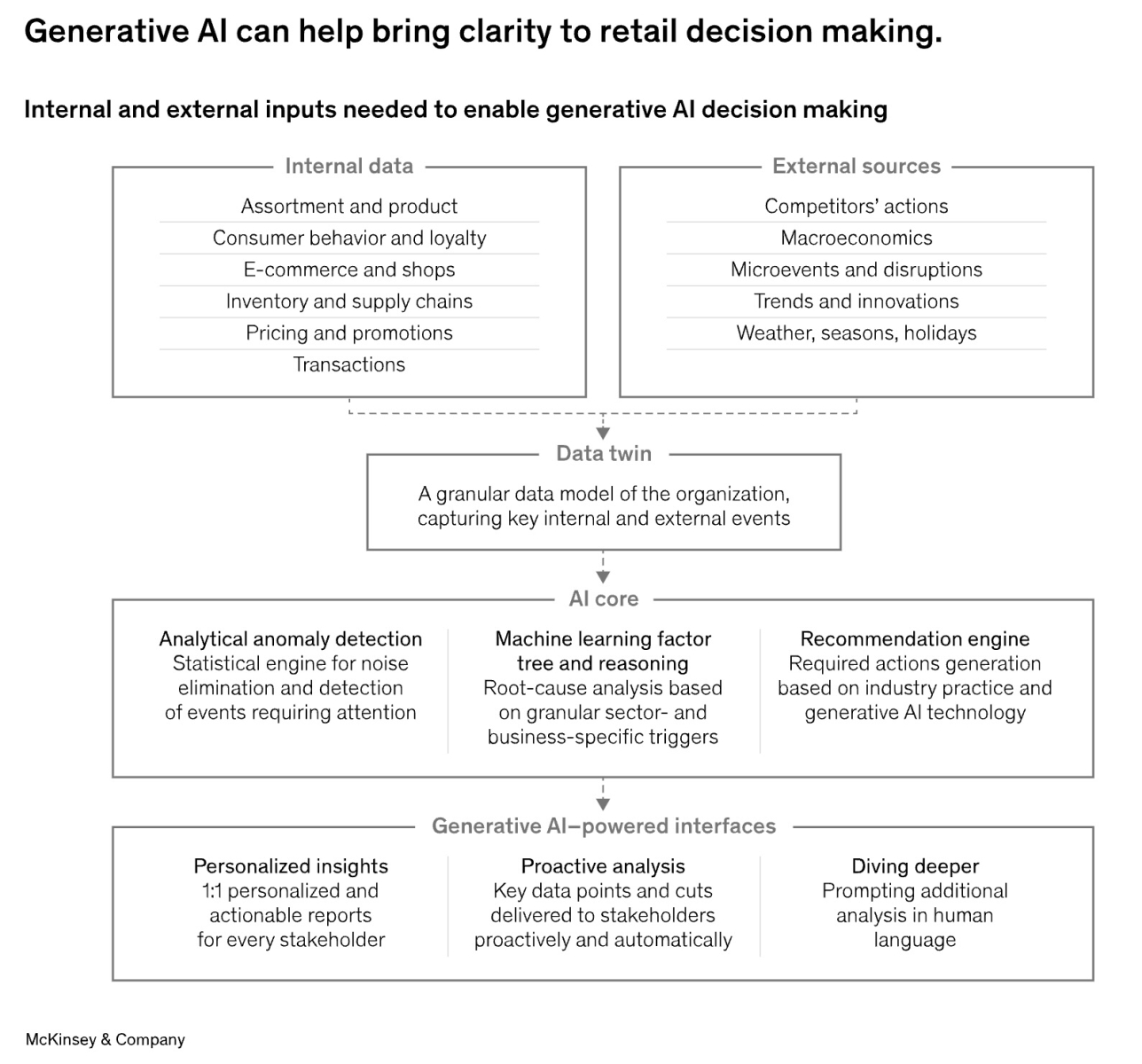

Retailers that have harnessed gen AI focused on specific use cases rather than dispersing resources across multiple scenarios, McKinsey said. They also transitioned from pilot programs to large-scale deployment, requiring robust data management and tech integration.

Successful retailers also used gen AI to enhance operations and decision-making. Online fashion retailer ZALORA, for one, recently launched an AI-powered customer service chatbot in several Asian markets, enhancing inquiry handling and providing personalised information.

Modular components

Generative AI chatbots such as ChatGPT have revolutionised customer interactions by providing personalised recommendations and information. The ease of use and ability to generate text, images, videos, and other data have made them very popular, according to Euromonitor International.

But consumer trust in AI chatbots varies. Whilst over 40% of consumers are comfortable with voice assistants offering personalised recommendations, fewer than 20% trust chatbots with complex customer service issues, it said.

A June 2024 study by London-based market research firm YouGov showed that 71% of consumers expect companies to be accountable for inaccuracies in AI chatbot responses, with higher expectations in regions like Australia (80%) and Hong Kong (78%).

Implementing gen AI chatbots is expensive, and the cost depends on factors such as conversation length and purchase conversion rates, McKinsey said. Although a 2% to 4% increase in basket size can justify the investment in large language models, retailers should also account for development and customer acquisition expenses, it added.

Retailers should identify areas within their business — customer experience, marketing, or employee productivity — where gen AI applications can have the most impact.

Investing in workforce development is also crucial, involving training for both technical and nontechnical staff to build expertise in gen AI software development and prompt engineering, McKinsey said.

Meanwhile, leaders across the organisation can help fast-track scaling in the short term, while ensuring that gen AI initiatives align with business goals.

For retailers that are not ready to invest in chatbots, smart-search tools offer a simpler, less costly alternative. They recommend products based on search queries and are easier to develop and deploy than full-scale chatbots, McKinsey said.

Developing a flexible technology architecture is also important. Retailers can experiment with different gen AI vendors to assess which one will best suit their needs. They can also use modular components that can be easily swapped out, allowing them to scale solutions across product and market combinations, the consulting firm said.

Lastly, improving data quality is essential. Unstructured data sources will differentiate one from other retailers, while better metadata tagging standards will let tech teams more efficiently power a retailer’s gen AI models.

Questions to consider:

1. What emerging trends or technologies in gen AI should retailers consider to stay ahead in the next five years?

2. How can retailers balance their investment in generative AI and the need to innovate and adapt in their technology strategies?

Advertise

Advertise