How will the rise of 'hermit consumers' impact the future of the F&B industry?

'Hermit consumers' are a new type of consumer who prefers staying home to dining out.

The global food service industry is experiencing difficulties, with several channels not showing signs of recovery. One of the contributing factors to the stalled growth of the food service sector is the emergence of a new type of consumer: the hermit consumer.

'Hermit consumers' are a new type of consumer who prefers staying home to dining out. Fourty-six per cent of consumers globally said they intend to eat out less frequently in the next three months, whilst 11% said they will stop altogether.

According to a GlobalData report, the food service industry did not return to pre-pandemic normalcy in 2023, with the value of sales in the food service sector having just increased by 3% since 2019 with overall transactions declining by 3% over the same period. Dine-in sales revenue also dropped by 12% compared to 2019.

“The idea of a post-pandemic recovery for the food service industry assumes that 2020-2021 was a blip – an exogenous, once-in-a-lifetime event which would halt progress for a year or two before normal trends and consumer behaviour resumed,” said Fred Diamond, Senior Food Consultant, Consumer Custom Solutions at GlobalData.

“However, during that period something changed. We have changed. People are still spending, and still consuming, but in a radically different way. This new type of consumer has been termed the ‘hermit consumer’ giving rise to the ‘hermit economy’,” he added.

The ‘hermit consumers’

The idea of a hermit economy is linked to concepts such as “cocooning” which is described as the phenomenon of people preferring to stay at home more over spending time outdoors. Diamond said that from 2020 to 2021, people stayed in more due to the pandemic. But from 2022 to 2023, inflation was cited as the main driver for staying indoors.

“This is four years of behavioural change on a global scale. The idea things could snap back to the way people saw the future from the vantage point of 2019 has to be abandoned, and the new landscape embraced,” he said.

Per region, Western Europe saw a 9% decline in the transactions for dine-in meals, whilst takeaways rose 23% in 2023 compared to 2019, but overall transactions were down 3%. GlobalData added that similar trends were observed in Asia and North America.

“In a way, this is no surprise. The major beneficiaries of lockdowns, such as delivery platforms, have of course aimed to maintain their new-found dominance. The rise in “ghost kitchens”, which are delivery-only food service outlets, has also served to cement this new landscape,” Diamond said.

In a survey by food delivery platform Deliveroo, it found that 68% of Singaporeans use food delivery daily, with 87% saying that delivery service allows them to make more of their spare time.

The lack of time to prepare meals and not wanting to cook are also amongst the reasons for using food delivery services.

Deliveroo also noted that the average spending of Singaporeans on food delivery rose to $88.80 (S$118) monthly from $81.28 (S$108) in the survey in 2022.

Bringing them out

To appeal to the hermit consumers, GlobalData noted that product innovation was amongst the key solutions, especially in the face of falling footfall and reduced spending.

Limiting the availability of new menu items or offers may push consumers to spend on the product as this might catch their interest. This can also help in building customer loyalty.

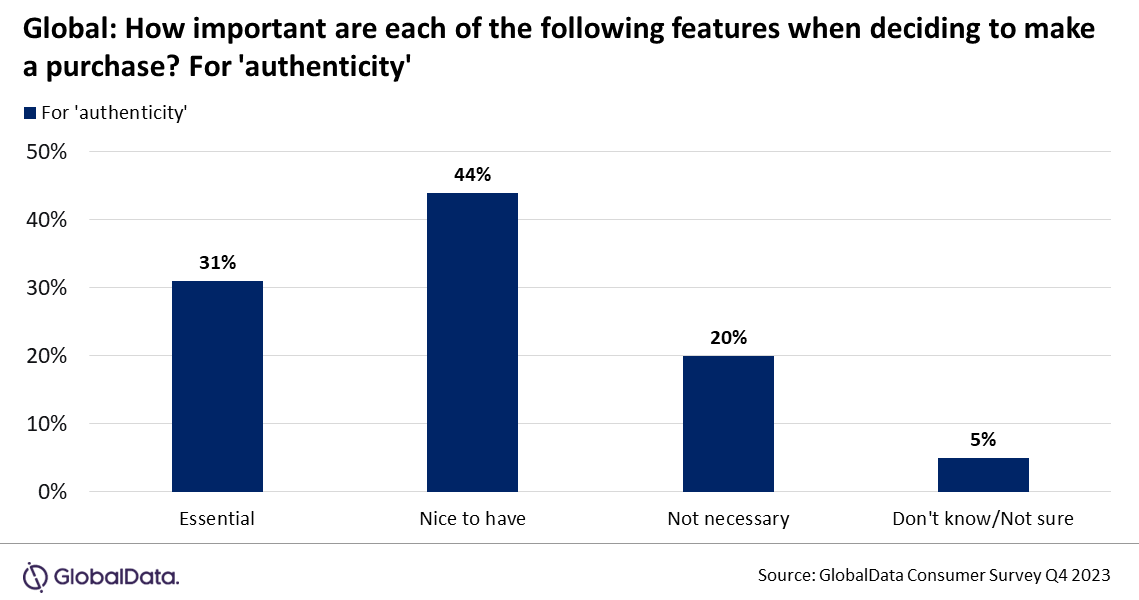

GlobalData added that ensuring authenticity and aligning with heritage can “resonate strongly” as consumers are cautious of products that seem” mass-produced, unoriginal.

Food service operators with no takeaway or delivery option should be flexible and adopt one as having no online presence can take a toll on their businesses.

Diamond also reminded operators that they should remember that consumers can choose cheaper food options, before deciding to lower their prices.

As such, they should instead focus on having good portion sizes and highlight the best they can offer, “contrasting them with what consumers might find in cheaper alternatives.”

Questions to consider:

- What specific measures can food service establishments take to encourage dine-in experiences for hermit consumers?

- How can food service operators strike a balance between offering delivery services to cater to changing preferences while also maintaining the appeal of traditional dine-in experiences?

Advertise

Advertise

EXPERT OPINION

Every crisis hides the seed of opportunity and future success. Like any other industry, F&B has reshapen itself during Covid and will continue to do so. Hermit consumers may be lured back out into the brick-and-mortar stores by the offer of entertainment, or maybe a new F&B concept will bring entertainment to them together with food, keeping them inside!

Communities could play a large factor in "bringing hermit consumers out."

The successes of Game Board Cafes, Haidilao, HW Gold Dragon, and many others in Indonesia, could prove the entertainment value while providing FnB. According to the owner of a major game board cafe chain in Indonesia, the average game board cafe in Indonesia has a break-even 3x faster than the average cafe.

Therefore, the additional activities or an entertainment value in FnB industry could be a new norm in the future.

Thursdays are the new Fridays and until or even if people return to the office we can expect work from homers to continue to avoid in store retail experiences.