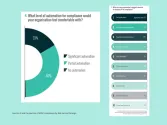

Around 7 in 10 SEA consumers wait for online sale seasons

The “deal-hunting” behaviour can be seen more in Singapore, Malaysia and Indonesia.

The online shopping behaviour of Southeast Asian consumers has not been spared by inflation, with 70% of the customers in the region more likely to wait during peak online sales seasons.

In a report, Blackbox Research and ADNA said the “deal-hunting” behaviour is observed more in Singapore (85%), Malaysia (81%), and Indonesia (71%).

About 64% of consumers in Thailand are also likely to wait for online sale seasons, and 59% of the customers from the Philippines and Vietnam are doing the same.

READ MORE: Shopee, Lazada are top online selling platforms in SEA

Online sales seasons include Amazon Prime Day, Singles Day Sale and Black Friday Sale.

“Perhaps, this is the reason the overall proportion of online/digital purchase decreased by 9% this year compared to 2021. The exception to this trend are Singaporeans who reported that their overall proportion of online/digital purchase in 2022 has increased by 16% compared to 2021,” the report read.

Advertise

Advertise