Three quarters of SE Asia firms plan to increase investment in e-commerce

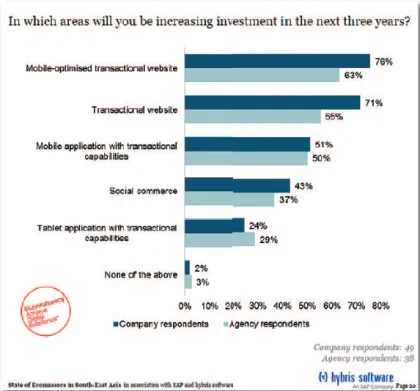

Mobile commerce is expected to come to the forefront and will be a key focus for four in five organisations, with around three-quarters (76%) planning to increase investment in mobile-optimised transactional websites over the next three years. Additionally, half (51%) plan to invest more in mobile applications with transactional apabilities.[/caption]

THREE out of four organisations in South-east Asia say they are going to experiment heavily with e-commerce during the next 12 months. Additionally, the vast majority (90%) are working towards delivering a unified customer experience across online and offline channels.

Mobile commerce is expected to come to the forefront and will be a key focus for four in five organisations, with around three-quarters (76%) planning to increase investment in mobile-optimized transactional websites over the next three years. Additionally, half (51%) plan to invest more in mobile applications with transactional capabilities.

The State of Ecommerce in South-East Asia report, published by Econsultancy in partnership with hybris software, an SAP company, is based on an online survey of 122 marketers and agencies, plus in-depth interviews with a range of senior digital marketing and e-commerce practitioners. More than half of the respondents are based in Singapore, with the rest mainly from Malaysia, the Philippines and Thailand.

While three-quarters of companies surveyed agreed that they understand the importance of Omni channel, around a third (31%) currently do not have a strategy to embrace this.

When asked about the most significant challenges to growing an e-commerce business, lack of budget and resources emerged as the most common problem, cited by 59% of company respondents and 39% of supply-side respondents as one of the three greatest barriers to success. The second biggest issue was a lack of integration with the rest of the business, with 45% of companies and 47% of agencies reporting this to be a barrier. The report also found that two in five (41%) companies surveyed have a separate e-commerce budget.

Advertise

Advertise