How can fashion brands turn sustainability pledges into actions?

McKinsey says 40% of fashion brands reported rising emissions since making public commitments to decarbonisation.

A LOT of fashion companies have made public pledges to take on eco-friendly procedures and produce sustainable clothes. But turning these promises into tangible results remains a significant challenge.

To meet these decarbonisation goals, brands need to focus on integrating sustainability into their value propositions, developing detailed emissions reduction roadmaps, and implementing advanced management practices.

According to a recent McKinsey report, about two-thirds of fashion brands are lagging behind their decarbonisation targets, with 40% having reported an increase in their emissions since making their sustainability pledges.

Green barriers

Resource constraints and a focus on tightening profit margins often push sustainability initiatives to the background. The report said this challenge is compounded by the perception that sustainability efforts involve immediate costs, either financial or operational, whilst benefits manifest in the long term and are difficult to quantify.

Effective decarbonisation requires comprehensive changes across the entire operational model, including design, sourcing, marketing, and retail. Such extensive alterations necessitate new workflows and enhanced cross-functional collaboration which can be difficult to implement.

The complexity is increased by the need for detailed insights into the entire supply chain, including emissions hotspots, production machinery, and energy efficiency. Accurate emissions measurement and baseline setting also require primary data from manufacturing facilities, a level of transparency many brands lack.

Secondary data often results in discrepancies, with up to a 20% variance between life cycle assessments based on primary versus industry-average data.

Moreover, implementing large-scale decarbonisation strategies often proves more difficult than anticipated. Successful execution demands a rigorous approach similar to digital transformation, including the establishment of clear roadmaps, reporting mechanisms, incentives, and robust business ownership.

The report said that the fragmented supplier landscape also poses another challenge as fashion brands often work with numerous suppliers, making it impractical to address sustainability with each one individually.

Suppliers, in turn, often lack the resources to invest in sustainability improvements and depend on brands to drive these changes. However, brands may be disincentivised to finance such upgrades as they benefit competitors as well.

Currently, the global fashion industry is responsible for an estimated 3% to 8% of total greenhouse gas emissions, with projections indicating a 30% increase by 2030 if no additional actions are taken.

“There’s a particular sense of urgency for fashion to abate emissions as quickly as possible, since several countries that are likely to experience the greatest devastation from climate change are central to fashion’s value chain,” the report stated.

“Intense and frequent weather-related events occur in primary manufacturing countries — such as Bangladesh, China, India, and Vietnam — which export an estimated $65b worth of apparel,” it added.

Consumer demand

In a survey conducted by Delta Global, about 92% of luxury consumers in APAC said they would reduce their purchases or stop buying from brands lacking eco-conscious practices, with 27% stopping altogether. Consumers in Hong Kong, in particular, are slightly less likely to stop buying, at 14%.

It also said that APAC luxury consumers prefer brands that focus on sustainability, with over two-thirds willing to spend more on these brands.

Gen Z is even more committed, with 75% ready to increase their purchases, based on the poll. APAC consumers would pay up to 21% more for sustainable brands, and Gen Z would pay up to 28% more.

Bain & Co, likewise, reported that over 70% of consumers globally are willing to pay a premium for products with environmental or health benefits. In APAC, 90% of consumers are particularly eager to pay more, it said.

However, rising costs and inflation are widening the funding gaps for retailers investing in sustainability. Ninety-five percent of retailers’ carbon emissions come from their supply chains, and sustainable systems are more expensive.

Tin profit margins make it difficult for retailers to move from sustainability promises to actual progress.

“Inflation is of course making consumers more sensitive to price – but at the same time it’s also encouraging them to revisit deeply engrained consumption habits,” Luciana Batista, a partner in Bain’s Retail, Consumer Products and Sustainability Practices, said.

Bain & Co noted that higher inflation is worsening the funding gaps challenge retailers face as they invest in sustainability.

“The sector now needs to show it can continue to deliver improvements in sustainability when the economic landscape is more challenging. Those who stay behind will lose the hearts and pockets of customers,” it said.

Path forward

Amidst these obstacles, the fashion industry may be better positioned to meet its decarbonisation targets than it appears, noted McKinsey.

Many costs and value creation in the industry come from low-carbon activities like design and marketing, whilst emissions are concentrated in areas such as raw material production and shipping. Thus, significant decarbonisation could be achieved at a relatively modest cost.

The report suggests that fashion brands could reduce their GHG emissions by over 60% for less than 1 to 2% of their revenues. This excludes potential emissions reductions from practices like reselling and renting, which are dependent on shifts in consumer behaviour.

“Accelerating abatement without affecting the industry is achievable. In fact, it could be more affordable than fashion executives might think,” it noted.

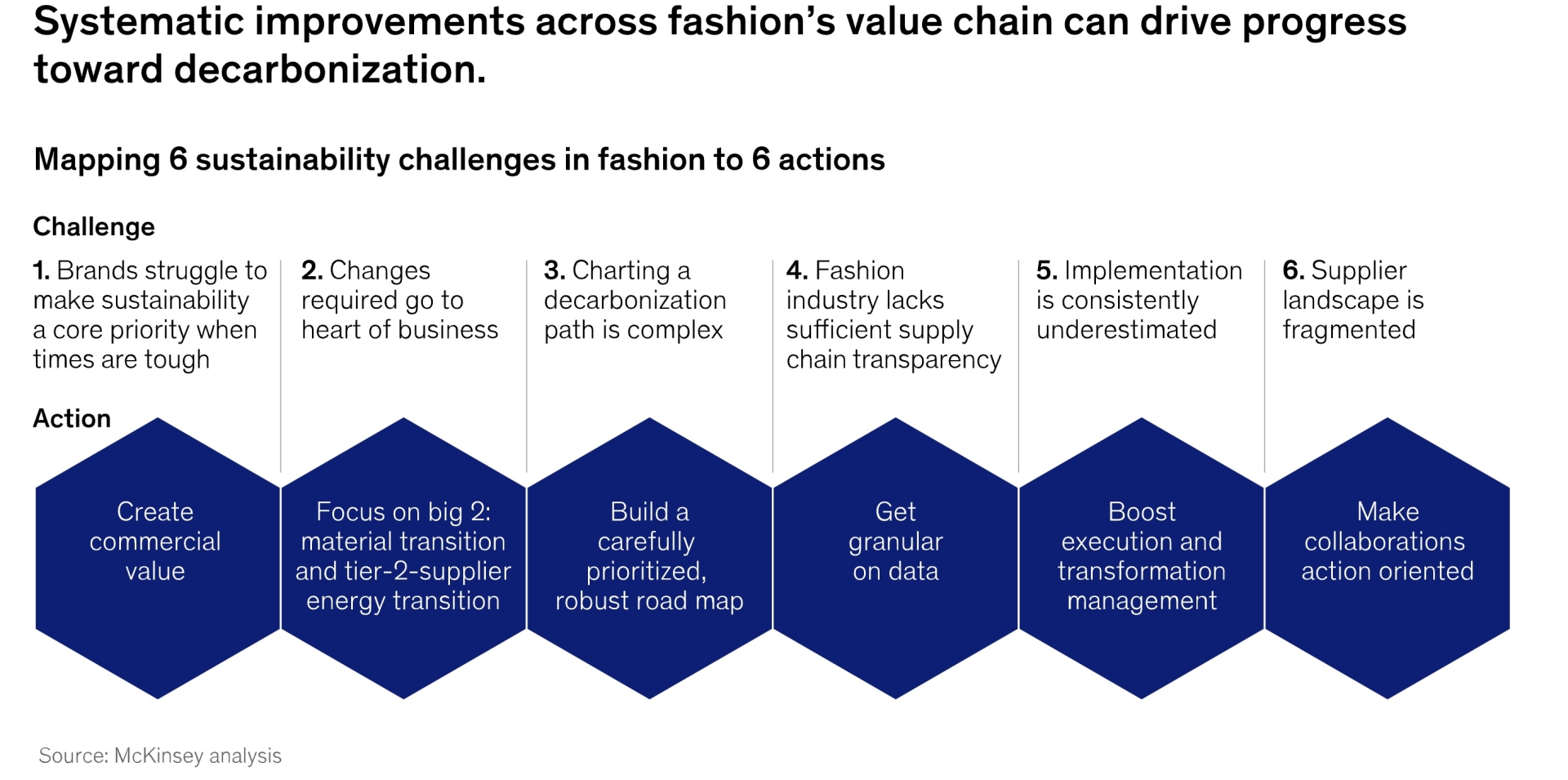

To accelerate decarbonisation in fashion, brands should take six key actions, including sustainability achievements to create commercial value by aligning with consumer expectations and highlighting these efforts through clear, substantiated product offerings.

They should also focus on green materials and improve energy efficiency in production as this area represents about 70% of the industry’s emissions as well as collaborate with suppliers to enhance energy use and shift to renewable sources.

Also, fashion brands should develop a detailed decarbonisation roadmap that outlines emissions baselines and strategies, and prioritise actions based on cost and impact, and use this plan to guide and speed up progress.

To improve data accuracy, there is a need to move from industry averages to primary data, and partner with experts to ensure reliable emissions tracking and compliance.

Enhancing execution and management is another must, so retailers could adopt a rigorous transformation plan, assigning clear responsibilities, tracking progress, and enforcing strong governance.

Finally, collaboration with other brands, suppliers, and financial institutions is highly recommended. Their goal would be to support industry-wide sustainability initiatives and access green technologies and funding.

Questions to consider:

1. How can brands manage high initial costs and resource constraints in their decarbonisation efforts?

2. What are the best strategies for fashion brands to integrate sustainability into their operations?

Advertise

Advertise