Pandemic drives e-commerce boom in Malaysia

International e-wallets such as Google Pay and Masterpass are gaining steam.

The COVID-19 pandemic has ramped up the adoption of online payment platforms in Malaysia as consumers gradually switch from offline to online purchases, according to data and analytics company GlobalData.

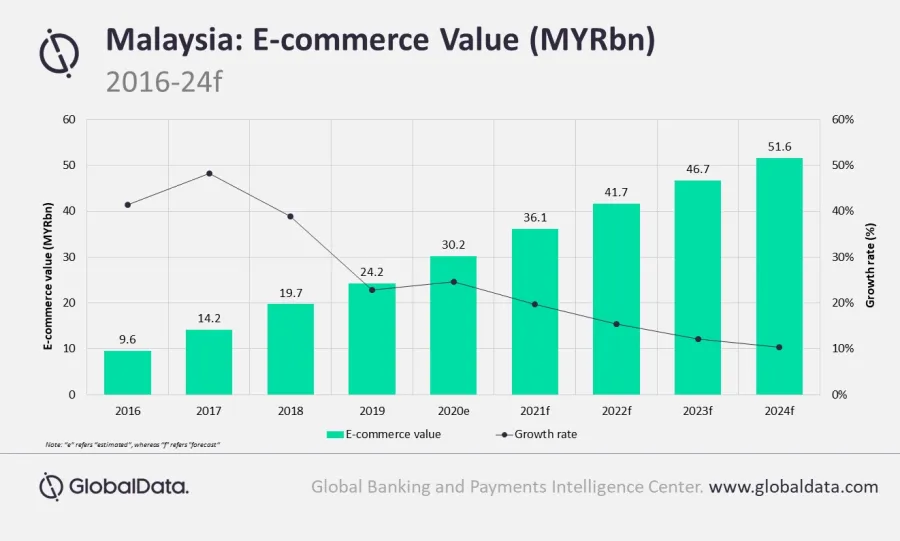

The local e-commerce market is estimated to register 24.7% growth in 2020. The market is expected to reach $12.6b (MYR51.6b) by 2024, increasing at a compound annual growth rate (CAGR) of 14.3% between 2020 and 2024.

It got a further boost thanks to the government’s $34.2m (MYR140m) three-month campaign to drive e-commerce adoption amongst small merchants and help widen their reach across the country, which began in June.

Furthermore, consumers are increasingly cautious of contracting the virus through cash handling and visiting physical stores, especially with the COVID-19 outbreak still ongoing, said Nikhil Reddy, banking and payments analyst at GlobalData.

“Malaysia is amongst the fastest-growing e-commerce markets in Southeast Asia, driven by rising Internet and smartphone penetration, growing middle class population and tech-savvy millennials,” Reddy said.

According to GlobalData’s 2020 banking & payments survey, payment cards is the most preferred payment method for e-commerce purchases in Malaysia, accounting for 40.3% share by value in 2020.Alternative payment methods are also gaining prominence with combined market share of 25.3%.

Whilst this space is mainly driven by domestic players—such as Boost, Touch N Go, GrabPay—international payment solutions like Google Pay, Masterpass and Visa Checkout are gaining popularity.

"Malaysian e-commerce market has been registering growth during the last few years, which has been further accelerated by the COVID-19 pandemic. This, coupled with the growing consumer preference for online shopping, availability of customized online payment options and government support, will further drive e-commerce market in Malaysia,” Reddy concluded.

Advertise

Advertise