How can retailers balance cross-border return fees and customer satisfaction?

In India, for instance, three in five consumers require free returns, posing a challenge for retailers.

One key factor that drives consumers in Asia Pacific to check out their items from a different market is a free and simple returns policy. However, whilst this offering could help attract more consumers, free returns may pose a risk to a brand's profitability in the long run.

This creates a challenge for retailers on how they can meet the expectations of their consumers whilst still charging for processing returns.

According to Asendia’s Shipping and Returns report, the traditional practice of offering free returns is becoming increasingly unsustainable for many online retailers, with less than half currently providing this service.

Industry players like Zara and Asos.com have already made moves to adapt to this shifting landscape by transitioning to models that charge consumers for returns or introducing subscription-based services.

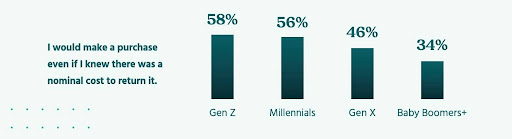

The report noted that approximately half of global shoppers are open to purchasing products even if a nominal return charge is applied. Interestingly, there are generational differences, with Gen Z more willing to pay than Baby Boomers.

Balancing revenue and customer satisfaction

Whilst charging for returns can provide a much-needed revenue stream for retailers, it also comes with potential drawbacks. A return fee may deter some customers from making purchases altogether, impacting sales and brand loyalty.

Regional differences in attitudes toward return charges further complicate the issue. The report revealed that shoppers in countries like South Korea, Switzerland, the UAE, and India are more accepting of return fees than others.

Additionally, a compromise between customer satisfaction and financial sustainability is seen as essential. The report said that retailers are also experimenting with offering free returns during promotional periods or on specific products.

Moreover, investing in technology to reduce return rates and improve the overall shopping experience is also crucial.

Lower prices as a primary incentive

According to DHL’s Global Online Shopper Survey 2023, approximately one in three people purchase products from other countries, with lower prices emerging as the primary incentive.

Participants from Brazil led this trend, with 63% identifying lower prices as their primary motivation for engaging in cross-border shopping. In APAC, 52% of Malaysians, 44% of Thais, 43% of Australians, 30% of Indians, and 21% of Chinese consumers cited lower prices as a key factor.

Meanwhile, participants from Sub-Saharan Africa and the Middle East and North Africa (MENA) highlighted "better quality" as a significant driver of cross-border purchases, with 56% and 48%, respectively emphasising this aspect.

The report also revealed that 49% of global customers prioritise a "free and simple" returns policy. In India, 57% of consumers said that this offering would give them the confidence and assurance to shop from overseas.

Nearly 50% of consumers from Australia, China, and Malaysia, and 44% from Thailand, also view free and simple returns as a driving factor in their cross-border shopping.

Free returns option

DHL found that free returns are a “big selling point” for many cross-border shoppers globally with 42% of the respondents saying they only buy from sites that offer such an option.

Specifically, this trend is most observed in markets in the MENA region with 58%.

In APAC markets, India is leading in placing a high value on free returns with 63% of the participants saying they will only buy from online shops with that kind of offering. This is followed by Thailand at 46% and Malaysia at 43%.

Only 37% of the Chinese respondents and 23% of Australian respondents will only buy from online shops offering free returns.

Despite this, 40% of global consumers will sometimes buy from shops that do not offer free returns, led by Australia amongst surveyed APAC markets at 50%.

Only 18% of the global participants consider free returns as not important if they are buying an item they want.

Additionally, survey participants cited several factors that contribute to their confidence in cross-border shopping, including well-packaged goods, transparent consumer rights, websites available in their native language, and carbon offsetting initiatives.

These elements collectively contribute to building trust and assurance amongst consumers engaging in international online purchases.

Questions to consider:

- How can retailers charge for cross-border returns without upsetting customers?

- What can retailers do to build trust in cross-border shopping, including clear and multilingual policies?

Advertise

Advertise