Embedded finance boosts inclusion for APAC's unbanked

Digital IDs and credit solutions target financial accessibility.

Digital IDs and credit decisioning, which are among the main contributions that stand out in embedded finance today, are crucial in onboarding unbanked segments and providing underserved populations, according to David Zhang, Regional Market Research Manager at Euromonitor International.

Zhang said that the collaboration between banks and fintech companies is fostering a new era of inclusivity by developing innovative payment solutions tailored to the needs of those traditionally left out of the financial system.

“Embedded finance has two key contributions," Zhang explained, highlighting the importance of digital identification and sophisticated credit decisioning in enhancing financial inclusion.

Digital IDs serve as a foundational step in bridging the gap for the unbanked. By enabling individuals to use digital platforms for identification and authentication, financial services become more accessible, allowing for a broader segment of the population to engage in banking activities and transactions.

This move towards digital ID systems is a crucial development in bringing the unbanked into the financial fold, ensuring they can participate in the economy effectively.

Furthermore, the advent of advanced credit decisioning technologies, combined with an abundance of accurate data, is helping to serve those previously considered credit risks. This approach allows for more nuanced and comprehensive evaluations of individuals' creditworthiness, beyond traditional metrics.

The collaboration between credit technologies and digital businesses, such as e-commerce platforms and online food services, is providing these individuals with opportunities previously deemed unattainable.

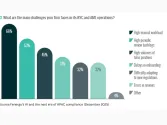

Zhang also discussed the larger framework of embedded finance within the traditional financial institutions and the challenges they face amidst this shift. The transition from old methodologies to agile, modern ways of operation marks a significant challenge for these institutions.

“The ways of working are still under a waterfall type of business development,” Zhang noted, emphasising the need for a cultural and structural shift within traditional financial institutions to adapt to this new landscape.

He said that alongside these challenges lie opportunities, particularly in optimising customer experiences and addressing the needs of underserved markets. Zhang pointed out that improving customer journeys across various channels and investing in advanced credit decisioning techniques can significantly impact traditional financial institutions' ability to cater to broader demographics.

Advertise

Advertise

Commentary

The festive season is a revenue moment – don't let friction or fraud derail it

All that glitters: Is luxury losing its shine, or finding a new one in Asia?