How can consumer goods companies adapt to the third wave of digitisation?

Only one of two leading firms achieves 80% of their digital transformation project targets.

Companies not integrating advanced technologies like generative AI and digital twin simulations into their products or services may soon face obsolescence. Experts warn that even half of leading consumer goods companies globally are struggling to meet 80% of their digital transformation goals.

In the first two waves of digitisation, technology drove companies ahead by automating processes and digitising channels and supply chains. The third wave, focusing on differentiation, risks further widening the gap between leaders and laggards.

“In many ways, this wave of tech, which is aimed at delivering a competitive advantage in critical digital capabilities such as sales, marketing, and innovation, is the trickiest but the most important in predicting a consumer product company’s fate,” said Rajesh Narayan, a partner in Bain & Company’s Consumer Products and Enterprise Technology practices.

According to Bain & Company, companies often fail to gain digital advantages due to a lack of digital ambition. Inadequate operating models, poor technology architecture, talent issues, and unbalanced current technology needs with future requirements compound this issue.

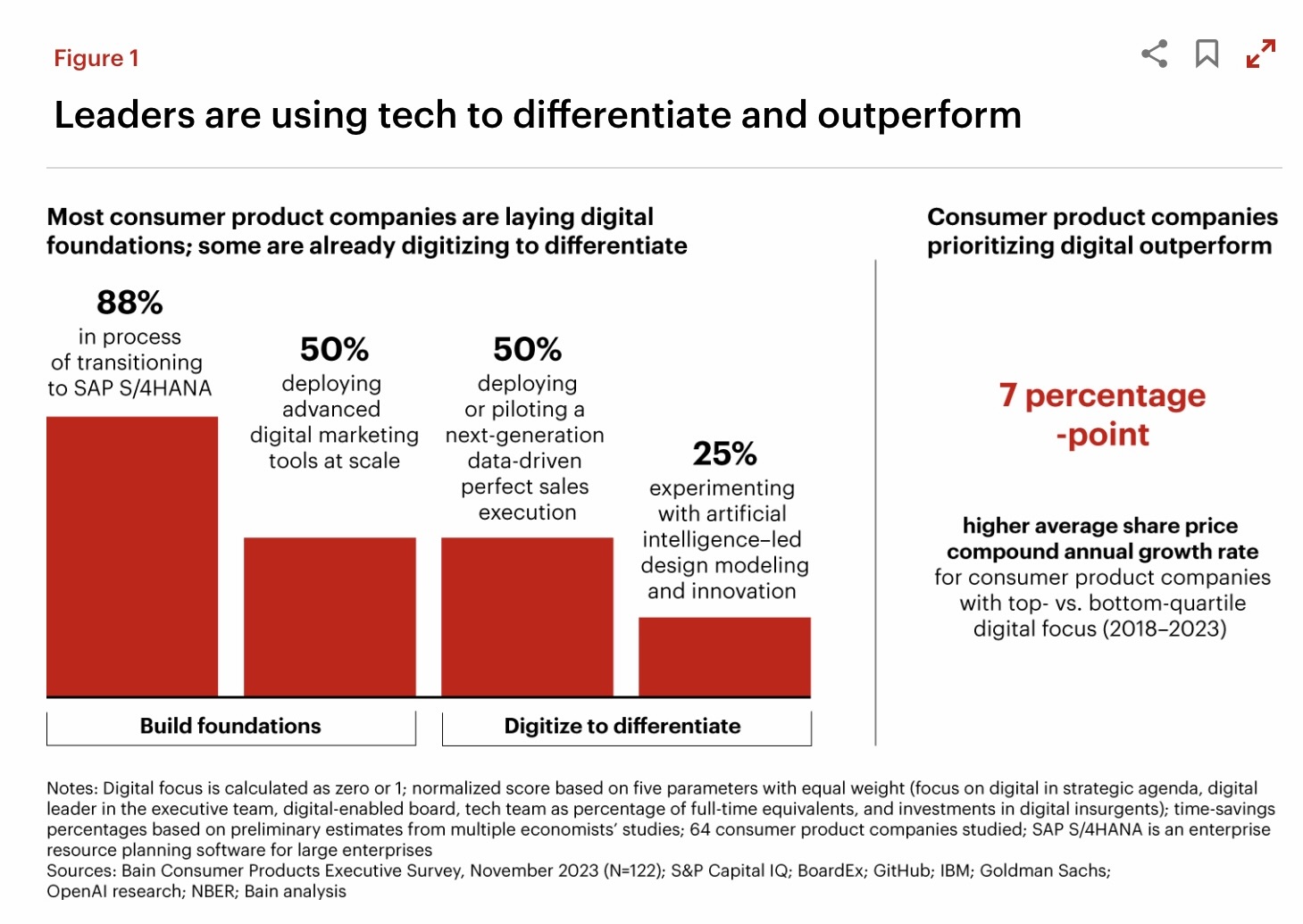

Companies that significantly increased their technology investments over the past five years report greater growth in share price, revenue, and profits compared to their less-investing counterparts.

Advanced tech adoption

AI-driven design modeling and data-driven sales optimisation strategies are being actively adopted amongst consumer goods firms, with approximately 25% experimenting with AI and 50% testing data-driven strategies.

Top-quartile consumer goods companies also allocate 60% more of their revenue towards consumer, customer, and innovation capabilities than those in the bottom quartile. These leaders are pioneering AI-led pricing strategies and digital twin simulations to drive product innovation and operational efficiency.

Speaking to Retail Asia, Olivier Gergele, EY's Asean Consumer Products and Retail Leader, emphasised the benefits of AI technology in automating tasks, improving efficiency and accuracy, and enhancing customer experience. He noted that adopting AI allows businesses to allocate talent to more strategic roles.

Gergele cautioned that companies not leveraging AI risk are missing out on optimising operations in inventory management, supply chain logistics, and pricing strategies.

In Asia-Pacific countries like South Korea, China, and Japan, technologies like generative AI are gaining traction, influencing consumer behaviour across regions, as per Euromonitor International. Developed markets and major cities in emerging economies like Shanghai are witnessing innovations like AI avatars and unmanned stores, aimed at reducing operational costs amidst rising labor expenses.

Offline retailers are also increasingly adopting customer-centric designs such as experiential stores and in-store dining to counteract the influence of e-commerce.

Despite these strides, many consumer product companies struggle with articulating a clear digital strategy and face challenges in talent acquisition and operational execution.

Digital strategy and talent acquisition

To attract top talent and drive innovation, companies must design compelling employee value propositions and upskill leaders in digital fluency.

“The best companies will use in-house talent for key roles in differentiated capabilities and use strategic partners or vendors for more commodity-related capabilities, niche skills, or to meet temporary workload peaks,” the report noted.

Bain & Company said that consumer product companies aiming to secure future success must also adopt a multifaceted approach such as leveraging AI extensively to enhance decision-making in areas such as product development, SKU management, and promotions, utilising AI tools and retailer data to optimise net revenue and identify top-performing products.

Additionally, capitalising on the proliferation of digital touchpoints by personalising interactions through generative AI-driven content creation is crucial to cater to the increasing number of consumers researching and purchasing products online.

Enhancing efficiency and agility through generative AI for digital content creation and digital twin simulations in R&D and supply chains will also be essential for maintaining competitiveness.

Moreover, establishing transparent supply chain data streams can meet consumer demands for sustainably sourced products, enhancing brand credibility and attracting environmentally conscious consumers. About 75% of consumers in developed economies are willing to pay extra for brands that source sustainably.

Lastly, consumer goods companies must embrace SAP S/4HANA and other advanced technologies to scale innovative solutions effectively. Establishing transparent supply chain data streams also meets consumer demands for sustainably sourced products, enhancing brand credibility and consumer loyalty.

Questions to consider:

1. How can consumer goods firms effectively align their digital transformation with advancements in technology and digital skills within the industry?

2. What specific strategies should consumer goods firms adopt to effectively personalise customer interactions and optimise sales execution using AI-driven innovations?

Advertise

Advertise