Nearly 7 in 10 shoppers prefer physical stores this festive season

Still, many will switch between channels to meet their needs.

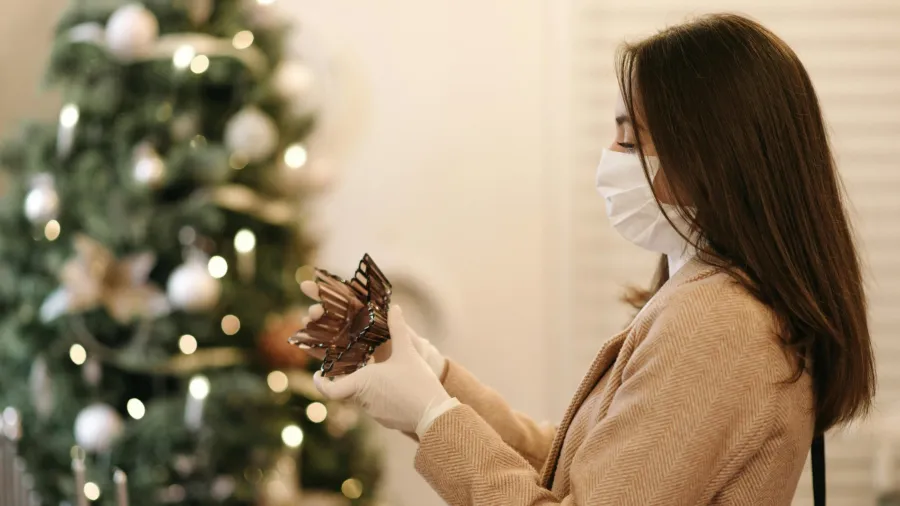

As the festive season approaches, physical stores remain the top choice for global shoppers, with 68% of consumers planning to make in-person purchases.

According to a report by EY, many consumers prefer to see, touch, and experience products in person before committing to a purchase, providing a level of confidence that digital platforms struggle to replicate.

Despite this, today’s savvy shoppers are seamlessly switching between physical and digital channels, amplifying the fragmentation of the retail landscape.

Social media platforms like TikTok, YouTube, and Instagram are emerging as key sales channels this holiday season, particularly in China, where social commerce is highly advanced.

Nearly 50% of Chinese consumers plan to shop via shoppable social media, compared to 24% in the U.S. and 17% globally.

Features such as in-stream shopping on TikTok, introduced in the U.S. in 2023 but available in China since 2020, demonstrate how the pandemic accelerated social commerce adoption in some regions.

Globally, consumers are expected to increasingly embrace social sales channels as brands enhance their digital experiences to mimic in-store shopping. For instance, social livestreams now allow consumers to interact with trusted influencers, ask product questions in real-time, and make purchases directly through pop-up links.

Shoppers are also prioritising price over product, with promotions playing a key role in where they choose to buy. For brands, this increases the challenge of navigating fragmented channels.

To stay competitive, the report said businesses must analyse and prioritise their most valuable channels, test shoppable social content to boost impulse buying, and use insights from this season to plan for the future.

Advertise

Advertise