How can luxury brands overcome a Chinese slowdown?

Economic instability and declining property values are driving the downturn.

Global luxury brands are grappling with a slowdown, especially in China, where consumers have become more selective and resistant to frequent price increases.

The luxury industry faces a notable crunch this year after record profits amidst an unprecedented demand for personal luxury clothing, leather goods, watches, and jewellery, alongside a strong supply chain, in 2019 to 2023, McKinsey & Co. said in a January report.

The growth was swift and remarkable, with “megabrands” generating annual revenues of more than $5.2b (€5b), driving greater visibility and desirability, according to the management consulting firm.

Price increases accounted for more than 80% of the sector's growth, whilst volume growth remained more modest, it pointed out.

For the first time since 2020, luxury value creation is expected to fall behind the previous year's performance. Several key drivers of growth, including price increases, have reached their peak.

As a result, demand is weakening, particularly amongst aspirational luxury consumers. Macroeconomic challenges especially in the crucial Chinese market, which contributed more than 18% annual growth from 2019 to 2023, are casting a shadow on the market.

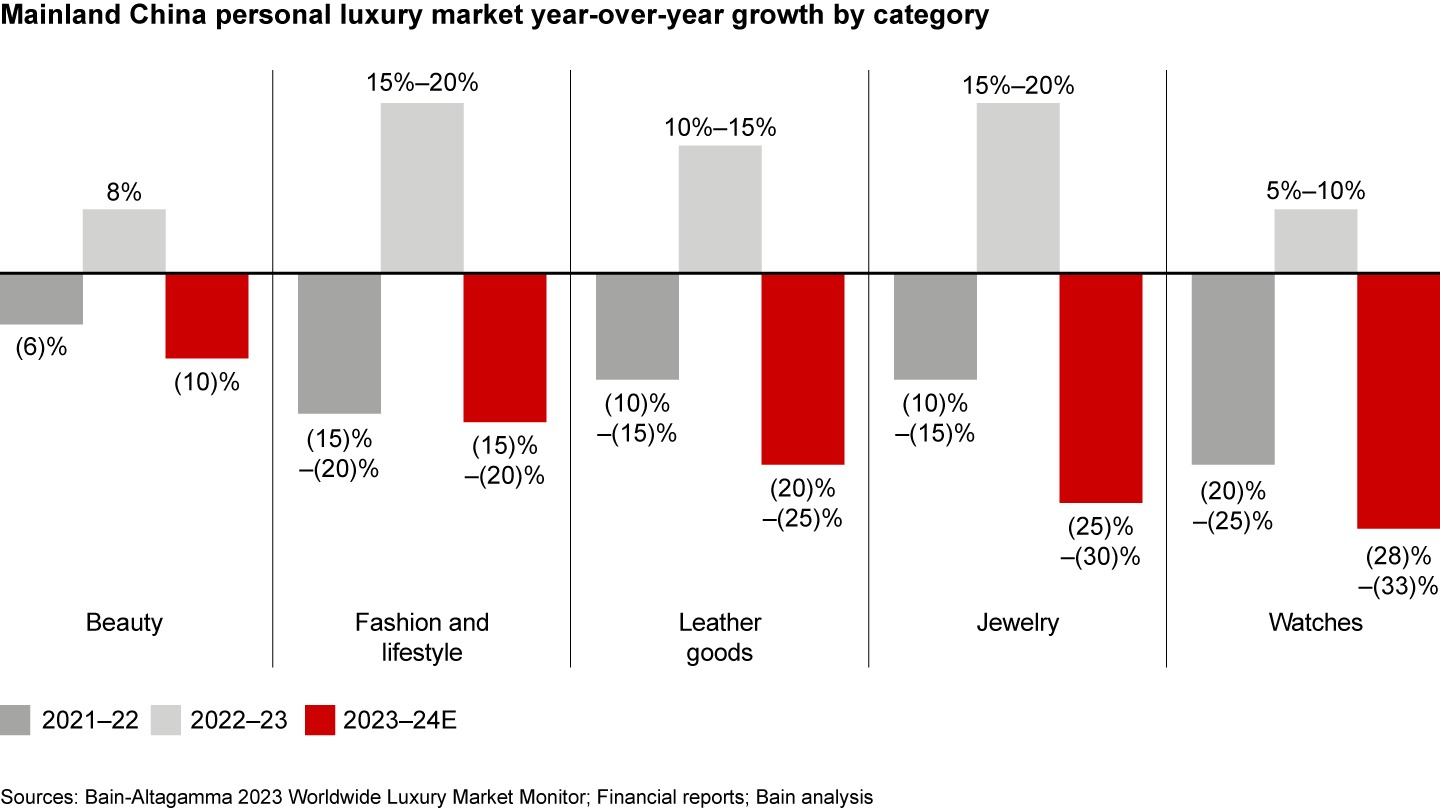

China’s luxury market slowed 18% to 20% last year, reverting to 2020 levels due to low consumer confidence and rising overseas spending as tourism rebounded, Bain & Company said in a separate report in January.

Uncertainty persists despite a slight recovery in the fourth quarter, with government stimulus measures on the horizon. Economic instability, declining real estate values, and consumer resistance to frequent price hikes have driven the downturn, according to the report.

All luxury segments experienced a decline, particularly jewellery and watches, as consumers shifted toward value-preserving assets and experiences.

McKinsey said consumers now demand experiences in addition to products, creating new challenges for luxury brands to compete with other high-end experiences such as luxury travel and wellness.

The rapid expansion of the luxury sector in the past five years has led to overexposure, diluting its promise of exclusivity, creativity, and craftsmanship, it added.

Whilst brands raised prices, many failed to adjust their creative strategies and supply chains to meet the scale, weakening their value proposition and failing to meet consumer expectations, McKinsey said.

Even the most established brands are under increasing pressure as consumers question the industry’s commitment to quality and personalised service whilst demanding greater innovation.

McKinsey expects growth to slow in the coming years, with annual global growth projected at 1% to 3% from 2024 to 2027. Whilst emerging markets like the Middle East, India, and the Asia-Pacific region may offer some dynamism, core markets such as the US, Europe, and China will see only modest growth.

McKinsey said company executives should do a strategic reset by aligning their core values to key client segments, whilst continuing to invest in products that uphold luxury’s promise of quality and value.

Brands should also align business scale with craftsmanship heritage through long-term supply chain investments and best-in-class practices. They should also rethink their engagement strategy by developing unique, “money-can’t-buy” experiences for loyal clients, it added.

Brands should likewise leverage technology, artificial intelligence, and data to personalise client journeys and improve decision-making across the organisation.

Moreover, companies should bridge the talent gap by attracting and retaining top talent across all functions, not just in creative roles. Professionalising operations in areas such as digital, data, and supply chain by adopting best practices from other sectors will be critical, McKinsey said.

Luxury brands should also future-proof their portfolio by evaluating exposure to different luxury categories and regions, including travel and hospitality, to maximise customer engagement, it added.

Questions to ponder:

- What can luxury brands do to regain demand in China?

- How can they adapt marketing to resonate with a more discerning consumer base during a period of economic uncertainty?

Advertise

Advertise