Swarovski cracks TikTok to scale luxury amongst Gen Zs

The Austrian crystal maker is working with influencers to connect with the Singaporean market.

Swarovski has taken its renowned luxury crystals and gems to TikTok as it taps tech-savvy Millennials and Gen Zs as part of a bigger “luxury at scale” strategy, whilst still keeping to its core aesthetic.

The family-owned Austrian crystal maker, synonymous with sparkle, is adapting to changing times by blending opulence and value. To connect with the Singaporean market, Swarovski is working with local influencers and global icons like pop star Ariana Grande, whose charisma and individuality the company believes align with its brand's creativity.

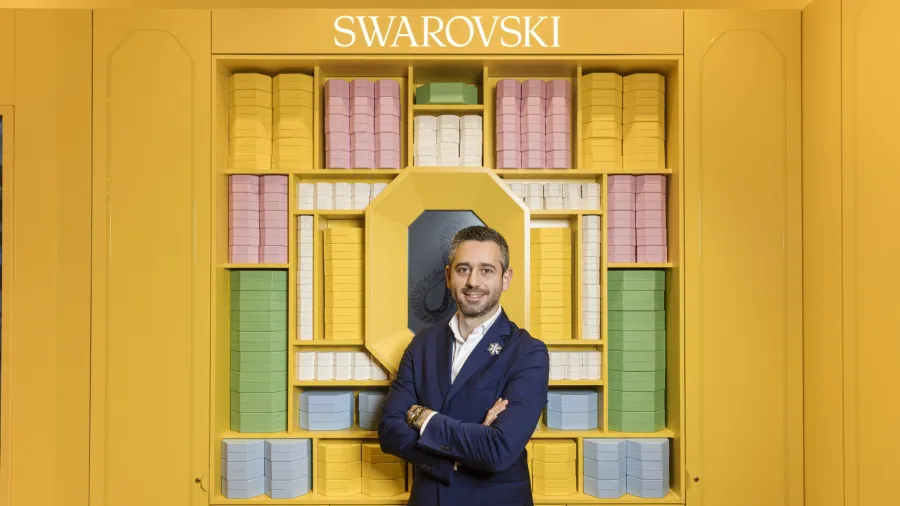

“This trend is not just about representation, but also about creating pieces that resonate with a wider range of customers, making luxury what we call more accessible and relatable,” Nasr Sleiman, managing director for India, Southeast Asia and the Middle East at Swarovski, told Retail Asia.

Swarovski's TikTok account has had 1.4 million likes from about 183,000 followers since its first video post in June 2022. It also has 8.5 million followers on Instagram.

Sleiman said they avoid getting lost in the noise by being part of relevant conversations. The marketing strategy “aims to help the brand grow, [to stay] top of mind, whilst at the same time being culturally relevant to all foundations around the world.”

Sleiman said pop-up and experiential marketing could create a big buzz and attract new customers.

Singapore's luxury jewellery market is worth $301.6m, with an expected annual growth rate of 4.27% until 2029. There is a healthy demand for exclusive and high-end jewellery in the city-state despite its small size.

Sleiman said the younger post-90s generation is a key market for Swarovski, founded in 1895, especially in markets like Singapore where consumer spending remains subdued.

"In Singapore, we’ve seen a rise in consumers who are more selective with their purchases,” he said. “They want the luxury experience, but they also seek value. Our approach allows them to enjoy the best of both worlds.”

“We believe that fashion and jewellery should not be taken too seriously, but rather be an enjoyable extravagance and expression of one's individuality and unique sense of style,” Sleiman said.

He added that Swarovski, one of the largest purveyors of crystal and a giant in the jewellery industry, continues to evolve as consumer trends and tastes change.

At the heart of Swarovski’s strategy is the seamless integration of online and offline experiences. “We ensure that luxury experiences transcend from online to offline," said Sleiman.

In 2023, Swarovski launched 12 pop-up stores, including three in Singapore, featuring exclusive products, interactive photo booths, and custom gifts. These events, with live music, refreshments, and local celebrities, drove a 56% increase in sales.

Swarovski Crystal Business, which makes crystal glass, jewellery, rhinestones, watches and accessories, posted 4% growth in global sales to $1.997b (€1.83b) in 2023, and a 10% like-for-like increase amid a slowing luxury market.

Retail sales rose 4%, whilst business-to-business crystals were up 5%, it said in a statement. Its top 10 markets achieved like-for-like growth, with sales in key cities up 13%. In-store growth was 5% and 4% online.

Advertise

Advertise