Singaporeans confident to go cashless for up to three days: Visa

Singaporeans are becoming increasingly certain about going cashless with 7 in 10 (68%) saying they can go without cash for an entire day, and almost half (42%) saying they can go cashless for up to three days, according to the 2017 Visa Consumer Payment Attitudes survey.

The majority of Singaporeans (85%) prefer electronic payments over cash, representing the highest preference for electronic payments in the South-east Asia region, followed by Indonesia (83%), Vietnam (77%) and Malaysia (71%).

Kunal Chatterjee, Visa country manager for Singapore and Brunei said: “Consumers in Singapore are leading a cashless and digital lifestyle and this is clear from our survey findings. We see that seven in 10 Singaporeans have successfully gone cashless for at least 24 hours. This is a testament of our success in Singapore credited to key industry players and the government who have been driving the Smart Nation agenda.”

“Singapore has one of the highest electronic payments penetration in the region. There is wide acceptance in most of the major merchant categories, although there are small pockets of traditionally cash-based segments in Singapore. We believe that we are on the right track and it is important to help more consumers and merchants understand and embrace the benefits of electronic payments as we continue to embark on the smart nation journey,” he added.

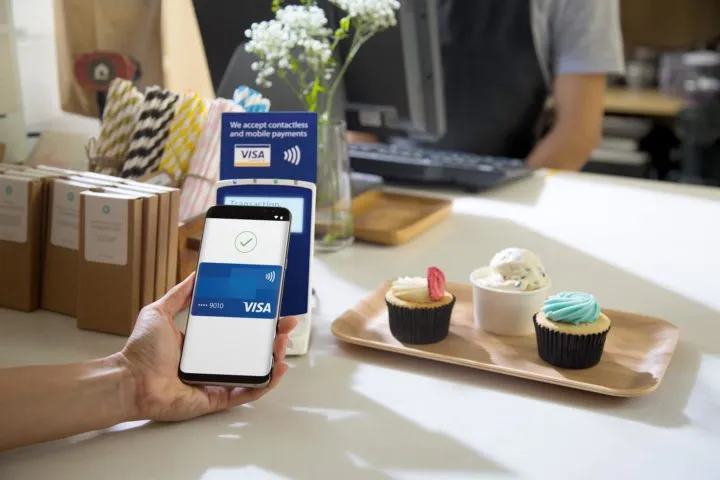

In terms of payment habits and sentiments, Singaporeans see cashless as a faster and more convenient way to pay. In fact, 74% say they currently do not use cash at point-of-sale, as they do not like to hold up the queue at checkout counters. Moreover, half of respondents prefer shops that accept electronic payment options instead of only cash (55%).

The study also showed that a third of Singaporeans are carrying less cash with them as compared to a year ago. The top reasons are due to increased payment card usage (66%) and contactless payments (55%).

Overall, Singaporeans are sure about the country becoming a cashless society, according to the survey. Twenty percent of them are confident that a cashless society is possible for Singapore in less than three years, while 41% believed that it will take four to seven years whilst 21% think it will take a longer period of eight to 15 years.

The SEA Consumer Payments Attitude Survey 2017– Report for Singapore was conducted by market research consultancy Intuit Research on 516 Singaporeans in mid-2017 to gain insights and assess their attitudes towards cash and card usage, mobile banking, contactless payments, online shopping and so on.

By Muneerah Bee

Advertise

Advertise