Asian consumer spending projected to hit $16t by 2024

It is largely driven by an anticipated $7t increase in private consumption over the next decade.

Consumer spending in Asia is projected to reach $16t by 2024, making up 27% of the global market, according to Roland Berger’s report “Unraveling Asia’s Complex Consumer Landscape.”

This growth is largely driven by a projected $7t increase in private consumption over the next decade, with China alone accounting for 60% of the surge.

Across most Asian markets, essentials such as food, non-alcoholic beverages, and household goods lead spending priorities. China, however, bucks the trend, with consumers favoring clothing, footwear, and leisure activities.

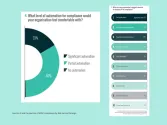

A growing emphasis on affordability is shaping purchasing decisions across the region, with price and earnings becoming pivotal considerations for many buyers.

“SEA populations have very diverse consumption preferences, brands need to truly understand the consumers, the personas they serve in each market if they want to capture the region growth potential,” said Hugo Texier, Partner Consumer Goods & Retail, Roland Berger Southeast Asia. “Ongoing experimentation with new product innovations and hyper-personalized offerings is essential for continuous success in this consumer landscape.”

Spending on luxury goods is also expected to decline in the next two years as consumers shift focus to sustainable and health-conscious products.

Additionally, online shopping is surging, driven by demand for convenience and safe transactions. Mobile payment solutions and integrated retail strategies are now essential for businesses.

Moreover, quality is the top priority for Asian consumers, especially for luxury and FMCG products. Local brands are highly valued, with Chinese products appreciated for affordability and Korean brands admired for their trendiness.

The report also added that ompanies that embrace affordability, sustainability, and quality will be well-positioned to succeed in Asia’s rapidly growing consumer market.

Advertise

Advertise