Innovations in F&B packaging cut down rigid plastics: report

Manufacturers are now setting plastic reduction goals and adopting recycled packaging.

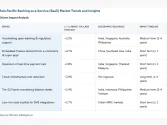

Rigid plastics, accounting for about one-third (31%) of global packaging materials as of 2019, are seeing a shift in usage patterns due to innovative solutions in the food and beverage industry.

According to GlobalData's Packaging Market Analyser, rigid plastics are projected to reach 1,459K million pack units between 2023 and 2026, growing at a CAGR of 2.6%.

The fast-moving consumer goods (FMCG) sector is a major contributor to plastic waste, with rigid plastics being a primary material for packaging items like bottles, containers, and caps.

The food industry uses these plastics for dairy, meat, fish, and seafood packaging, whilst the non-alcoholic beverage sector utilises them for soft drink packaging.

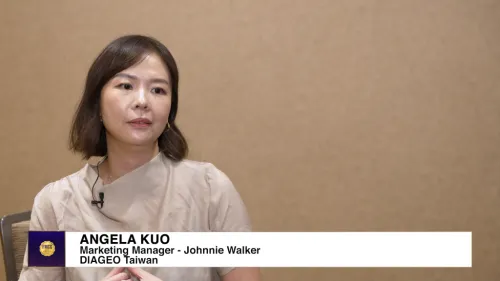

Chris Strong, managing consultant and packaging analyst at GlobalData, highlighted the industry's growth being fueled by demand for convenient and cost-effective food packaging.

“High global inflation has driven up input costs, pushing more manufacturers to rely on cheap materials such as rigid plastics,” he said.

“However, with incoming legislation such as the EU’s ‘Packaging and Packaging Waste Directive’, companies will have the challenge of minimising the material’s impact on the environment whilst maintaining the benefits it provides, such as the ability to offer durability in the supply chain,” Strong continued.

GlobalData's Q4 2023 survey revealed that 76% of consumers worldwide prioritise environmentally friendly packaging, with millennials at 75% and Central and South American consumers at 83%.

Responding to consumer concerns and regulatory pressures, manufacturers are also setting ambitious plastic reduction goals and adopting recycled plastic packaging.

ALSO READ: Starbucks certifies over 6,000 Greener Stores globally

Strong also noted the role of technology and digital capabilities in driving FMCG growth in 2024, aiding brands in meeting plastic reduction demands.

He added that many recent innovations focus on substituting virgin plastics, exploring alternative materials to minimise plastic use.

Major industry shifts include Sainsbury’s switching to cardboard for mushroom packaging, potentially saving 775 trillion of plastic yearly. Upfield launched a plastic-free tub for plant-based butters, and Starbucks now accepts personal cups to reduce waste. Additionally, Coca-Cola is testing label-less Sprite packaging in the UK to simplify recycling, whilst Tesco shifts to paper for pocket tissues. Companies like Novamont, P&G, and Nestle are also investing in biodegradable plastics.

“The use of plastic as a packaging material is, realistically, not going away anytime soon,” said Strong. “With this in mind, the industry needs to continue exploring innovations that make the material more environmentally friendly where it cannot be replaced with alternatives.”

Advertise

Advertise