Omnichannels account for nearly half of $15b Australian online sales

Social media, AI, low costs and out-of-home returns push consumers towards omnichannels.

Omnichannel strategies that blend online and offline experiences have outweighed more than exclusive online sales, with 48% of Australian online non-food sales in 2023 having physical touchpoints, a report said.

According to the “Ecommerce Delivery Benchmark Report 2024” from ShipStation parent company Auctane, familiar routines like in-store browsing and returns have balanced out personal shopping journeys along with the influence of social media and AI.

Trending platforms like TikTok and Instagram have been more reliable channels for product discovery than regular retailer websites. Nearly 40% of users depend on social media for preferences and research, compared to 35% who browse retail websites.

Artificial intelligence has also made the rounds in shopping experiences, with 31% of Australians seeing AI as valuable for order streamlining and delivery updates and 28% relying on AI for simple product searches.

ALSO READ: Rise of minimarts compels large-format stores to rethink growth strategy

Given the rising cost of living expenses, Australian consumers have become cost-sensitive. Nearly half of respondents (48%) find the cost of delivery as crucial when shopping online. This aligns with 71% avoiding checking out items with large delivery costs and 44% being unwilling to pay for premium deliveries.

Adding to that are consumers looking for out-of-home returns. 31% of Australian respondents prefer in-store returns and 21% choose PUDO (pick-up/drop-off) locations. Gen Z consumers have also shown reliance on out-of-home returns, returning an average of 19% of apparel purchases.

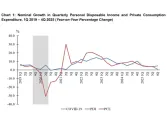

Whilst inflation slows down, Australian merchants have considered three major concerns – rising overhead costs (37%), weak customer demand (31%), and intense competition (27%) – that will define 2024. Providing a quality frictionless customer journey is the reliable way for brands to stand out in a competitive omnichannel landscape.

Advertise

Advertise