SEA social commerce growth doubles as shoppers buy, spend more: report

Orders through social media jumped by over 100% in the first half of the year.

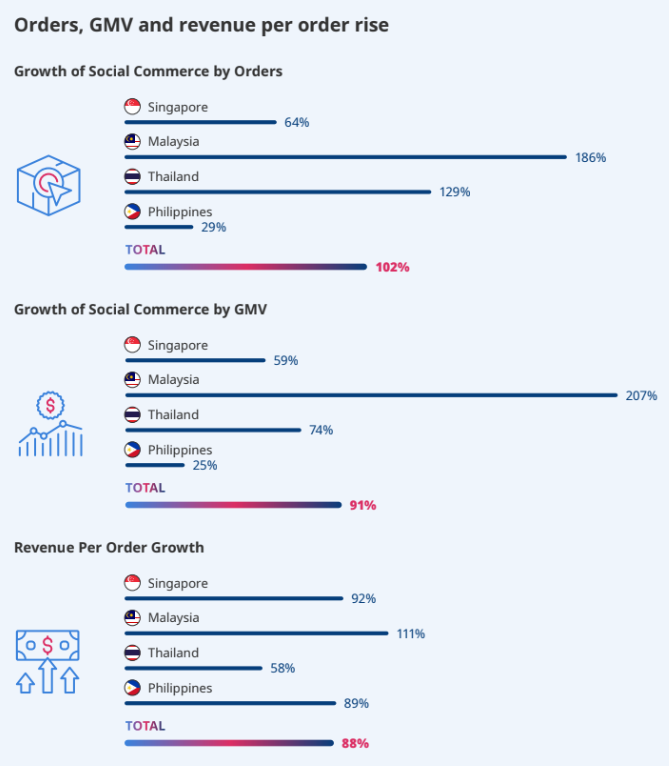

The growth of social commerce in Southeast Asia will not likely slow down as social shoppers’ order jump by 102% in the first half of the year, a report found.

In its annual study, “Riding the Pandemic Wave & Beyond,” iKala also reported that the gross merchandise value (GMV) climbed by 91% over the same period.

“Southeast Asia already had some of the most avid social media users in the world, and spurred by the pandemic, they’ve taken to social platforms for their shopping needs at an exhilarating pace,” Sega Cheng, Co-Founder and CEO, iKala, said.

“Even as brick-and-mortar reopens, it’s become clear that social commerce is not a phase — the ease, convenience and accessibility of this format has earned it a permanent place in the way this region shops.”

The study surveyed some 1,600 social shoppers and over 23,600 business customers (social sellers) across Thailand, Malaysia, the Philippines, and Singapore in the first and second quarter of the year.

The report noted that e-commerce (91%) maintains its position as the most preferred channels amongst consumers in the region, followed by social commerce (78%) which overtook traditional retail (35%).

iKala also found that some 42% of total shoppers have used social media to make 1-2 purchases per month, whilst 35% shopped through the platform more than 3 times in a month.

Beyond the increase in orders, the report also revealed that consumers are spending more as revenue per order increased 88% over the same period.

“Southeast Asia already had some of the most avid social media users in the world, and spurred by the pandemic, they’ve taken to social platforms for their shopping needs at an exhilarating pace,” Cheng also said.

“Even as brick-and-mortar reopens, it’s become clear that social commerce is not a phase — the ease, convenience and accessibility of this format has earned it a permanent place in the way this region shops.”

Advertise

Advertise