Aussie consumers losing trust in supermarket pricing

Shoppers are confused on pricing strategies such as frequent specials, short-term discounts, and bulk promotions.

A growing number of consumers are expressing concerns about supermarket pricing, according to a recent report from the Australian Competition and Consumer Commission (ACCC).

In its Interim Report for Supermarkets Inquiry, shoppers are increasingly comparing grocery prices online before heading to stores, but many are finding it difficult to identify the best value for products. These frustrations were shared with the ACCC, as consumers highlighted challenges in navigating fluctuating prices and sales promotions.

"Many consumers have told us they are losing trust in the sale price claims by supermarkets," ACCC Deputy Chair Mick Keogh said.

Key concerns revolve around supermarket pricing strategies, including frequent specials, short-term discounts, bulk-buy promotions, member-only pricing, and bundled deals. These tactics, according to shoppers, create confusion and hinder their ability to make informed purchasing decisions.

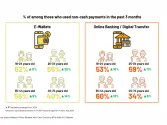

Abour 50% of respondents ‘always’ or ‘most times’ compare prices between stores before shopping. This marks a significant increase from the ACCC’s 2008 Grocery Inquiry, where only 17% of consumers said they routinely compared prices.

The emergence of member-only pricing has further fueled distrust, with many consumers feeling pressured to join supermarket loyalty programs. Some fear they are being penalised for not participating in these programs, which often require sharing personal data.

“With the introduction of member-only pricing, some consumers may feel they have no option but to participate in loyalty programs, even if they have concerns about handing over data to the supermarkets,” Keogh added.

Meanwhile, grocery suppliers have also raised serious concerns, telling the ACCC that they often receive prices below the cost of production and are forced to accept unfavorable terms imposed by major retailers. Suppliers say these terms are frequently subject to change, adding uncertainty and risk to their operations.

Suppliers pointed to practices such as being required to pay rebates for specials and promotions, using retailer-specified advertising and transport services, and complying with burdensome accreditation and packaging requirements.

Perishable goods suppliers, in particular, have voiced strong concerns about supermarket procurement practices, including accreditation obligations, demand forecasting, and quality standards that transfer considerable risk to producers.

The ACCC said it is now investigating whether supermarkets are exploiting information asymmetries, leaving suppliers without the necessary information to make efficient business decisions. The final findings are expected to be included in the ACCC’s upcoming report.

Advertise

Advertise