Overall retail vacancy in China’s 16 major markets down to 11.01% in Q2

Brands are opening their first stores or are accelerating their expansion in China.

The overall vacancy rate in the retail market of the 16 major cities in Greater China declined to 11.01% in the second quarter, as several international and domestic brands opened their first store or ramped up their expansion in the market.

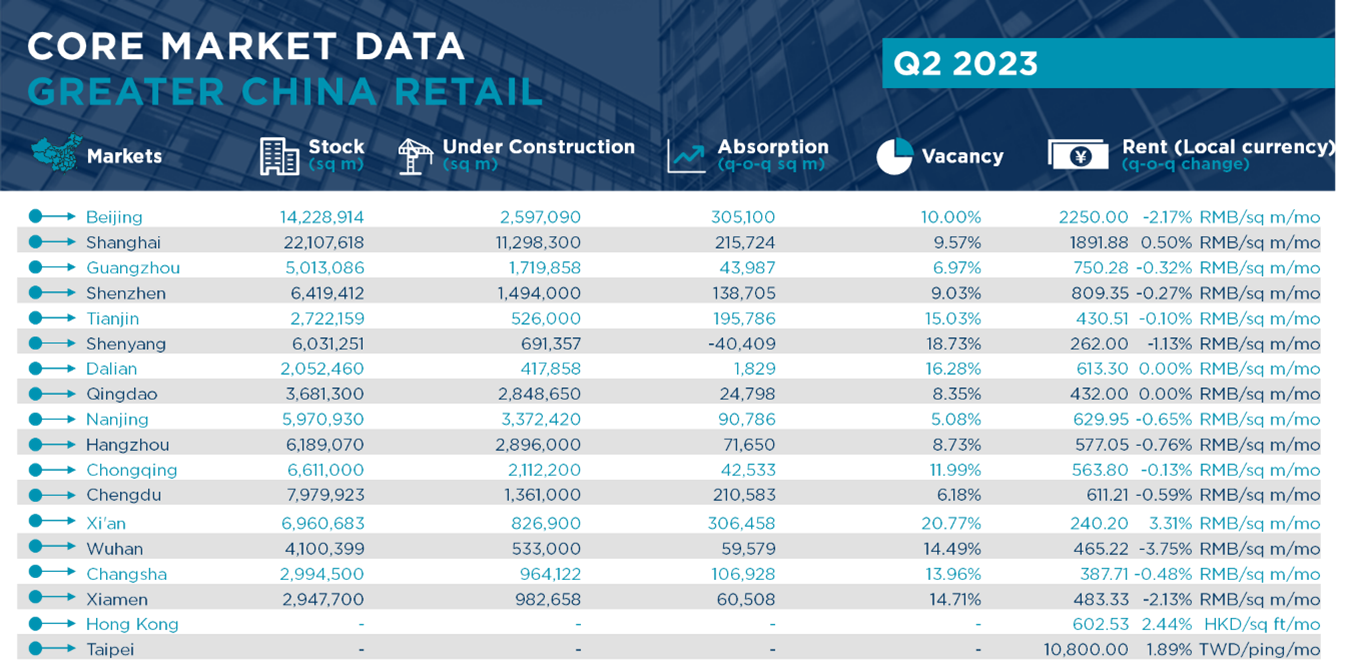

In a report, Cushman & Wakefield added that the prime retail property stock in the core markets in the 16 major cities reached 106 million square metres (sqm) during the quarter, whilst the net absorption in the premium core city retail property market was at 2.66 million during the first half of the year.

Data from Cushman & Wakefield.

The demand for retail space in many shopping centres in the first half of the year ranges from fashion, cosmetics, children-related goods and services, specialty restaurants, new style tea and coffee shops, cultural and creative products, smart gyms, and new energy vehicle experiences stores, amongst others.

ALSO READ: China will remain the leading e-commerce market: GlobalData

Duke Zhen, Managing Director, Head of Retail Services, China, Cushman & Wakefield, said, the “Consumption Boosting Year” activities led by the Ministry of Commerce and various consumption policies drove the consumer market to full recovery.

“China's retail property market is and will continue to be a popular investment destination for investors, developers and retailers, given the measures from the central and local governments to stimulate consumption, Chinese consumers' continual pursuit in upgrading the goods that they buy, the launch of retail property C-REITs, and the general sustainable development within the overall retail industry,” Zhen said.

Shaun Brodie, Head of Business Development Services, East China & Greater China Research Content, Head of Greater China Occupier Research, Cushman & Wakefield, said that retailers and landlords of shopping centres need to cope with the latest market trends to meet consumer demand.

Advertise

Advertise