China's cross-border e-commerce to reach US$190 billion in 2021

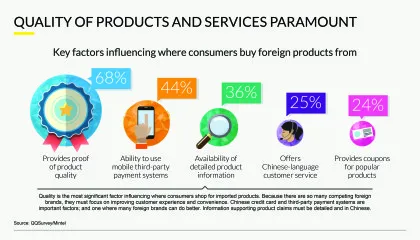

When choosing where to buy imported products online, Chinese consumers rank proof of quality as the most important (68%), followed by ability to use third-party payment systems (44%).

DESPITE rapid growth in recent years, the haitao (Chinese consumers buying from overseas) market is expected to peak within China’s overall online retail market. New research from Mintel revealed that in China, the total combined online cross-border e-commerce market, including B2B and B2C e-commerce, grew by a factor of 10, from RMB53 billion (US$7.7 billion) in 2011 to an estimated RMB626 billion in 2016, representing a compound annual growth rate (CAGR) of 64%.

From 2016 to 2021, growth is expected to slow to a still-strong CAGR of 15%, to reach a total value of RMB1.3 trillion (US$190 billion).

According to Mintel’s research, the majority of Chinese consumers today shop for foreign imported products from domestic shopping websites (73%), compared with only slightly more than one-quarter (27%) who shop from overseas retail websites. Indeed, more than double the proportion of consumers buy from physical stores within China (56%), rather than from overseas shopping websites.

Some products more desirable from certain countries

Nonetheless, there is a clear association among Chinese consumers for some products to be more desirable from certain countries. Mintel’s research revealed that 31% of Chinese consumers acquire their imported food from Taiwan; 36% purchase alcoholic drinks from France (principally wine); and 45% buy beauty and personal care products from South Korea.

The only territory that saw an increase in purchasing among urban Chinese consumers over the past two years was France. Of those who have purchased imported products online, 16% bought imported products from France last year, up from 15% in 2015. Of those who have purchased imported products this year, 20% bought beauty and personal care products from France, while 36% bought alcoholic drinks, especially wine.

Matthew Crabbe, director of research, Asia-Pacific, Mintel, said: “While the haitao market has seen rapid growth over recent years, and should maintain strong growth for the foreseeable future, it is likely to peak soon as a proportion of online retail in China.

“This does not stop the haitao route to Chinese consumers from offering significant potential market opportunities to foreign brands but it does mean that haitao is likely to be more relevant to brands looking at initial market entry. Retailers and brands should therefore play to their different country specialities when attempting to differentiate from their competitors.”

Chinese e-consumer concerns and wants

When choosing where to buy imported products online, Chinese consumers rank proof of quality as the most important (68%), followed by ability to use third-party payment systems (44%). They also want detailed product information (36%) and Chineselanguage customer service (25%).

Additionally, almost four in 10 (39%) said they would like to see a better choice of payment options on overseas online shopping websites. Currently, 35% are less confident about the returns policies of overseas websites than they are of domestic websites.

“[Besides] providing a better and more entertaining experience for Chinese online shoppers of imported foreign products, brands and retailers can improve by providing better practical solutions. Offering better delivery, refund and returns options is a key area where overseas online retail websites can improve, as compared to domestic websites,” said Crabbe.

He added: “This does create logistical issues, but having links through domestic online retail portals can help combat this.”

The research further revealed that 62% of surveyed consumers who have purchased overseas products agree that online shopping for imported products lacks the excitement of shopping when travelling overseas, with 20% strongly agreeing. Additionally, 34% agree that they are excited when shopping from websites that run interesting advertising campaigns.

For the purpose of this report, Mintel said, the haitao market includes buying imported products from online shopping websites, including domestic and overseas shopping websites. It excludes purchasing imported products from domestic or foreign physical stores, or from duty-free channels while travelling.

Advertise

Advertise