How will China's FMCG sector shift post-pandemic?

Top brands benefit from strong brand equity and scale advantages.

A stay-home economy has driven up demand for top brands and local brands for China’s fast-moving consumer goods (FMCGs) sector that is expected to foster domestic consumption over the next few years as consumers clung to brands they trusted the most, analysts revealed.

According to a report from Bain & Company, whilst sales for the top five brands dropped 6% YoY in Q1 2020, all other brands fared much worse as it recorded 11% losses in average. Similarly, local brands endured a 4% loss, compared with 14% for foreign brands, as consumers clung to more familiar ones. There was also a shift to non-premium goods, which lost only 1% vs. the 12% for premium goods.

A separate report from Morgan Stanley agreed, saying that the FMCG leaders will gain share, whilst the tails are getting fatter on this front. The report explained that the sector is not highly concentrated, and its market share distribution of the sector follows a barbell shape. The strong brand equity of leading brands gave them an advantage amidst heightened safety concerns.

“In addition to that, scale advantages, strong supply chains (ensuring consistent flow of goods), sound financial positions (no working capital issues given interruptions), and well established distribution networks (ability to tackle all channels or redeploy goods across different channels) are all key factors for leading players to gain market share,” the report added

Furthermore, reshored consumption amidst a slowing globalization is projected to hit $140-165b in 2020 and $70-130b in each of the subsequent 2-3 years, mitigating the impact on domestic demand and supplementing consumption growth by 1-2ppt in 2021-23. This will especially benefit beauty products as well as luxury, sportswear, luxury cars, and travel and leisure.

Meanwhile, the deeper e-commerce penetration in China made it easier for the smaller brands to grow. Bain noted that online channels enjoyed a healthy 19% YoY growth in Q1, whilst offline sales dropped by 13%.

Hype stays for hygiene products, home brands

Amidst lockdowns, quarantines and a tentative recovery, consumers also quickly adapted their spending patterns, reflecting in the shifts in the FMCG sector that varied in distinct ways depending on their place in consumers’ needs during and after the lockdowns, analysts found.

Bain found that hygiene products and brands that were widely used in stay-at-home situations not only surged during the pandemic, but also continued booming amidst recovery. “People spent more time cooking at home, so they bought more soy sauce, for example. Sales of these products remained strong as restrictions lifted, with consumers’ renewed commitment to their health and a continuing interest in cooking,” the report stated.

Meanwhile, consumer products that can be stocked up such as frozen food, packaged water and household cleanser were hyped during the lockdown weeks that eased afterwards, as consumers did not see a need to buy more as restrictions were lifted.

This was the other way around for products such as beer, skin care and pet food. “Sales dropped dramatically during the pandemic, only to quickly recover as consumers repurchased the products,” the report noted.

Lastly, categories such as makeup, which is not considered as essential for consumers wearing masks, and impulse categories such as candy declined, but are likely to just slowly improve in an L- or U-shaped recovery.

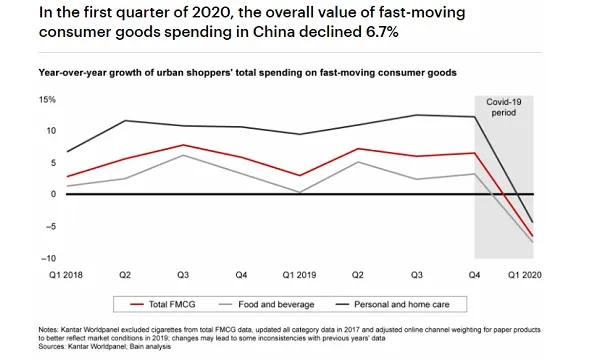

Overall, FMCG spending dropped by 6.7% in Q1, data from Bain revealed, with food and beverage spending falling 7.7%, and non-food and beverage spending declining 4.6%.

Advertise

Advertise