Weaker sales haunt Singapore's retail sector in coming months

Tourist arrivals are unlikely to grow in the coming months.

Though Singapore’s retail sector is expected to continue on its path to recovery, the absence of international tourism demand means that overall retail sales may still be unable to surpass 2019 levels, analysts commented.

Also read: Retail sales down 27.8% in June

According to a report from Knight Frank, international visitor arrivals (IVAs) are unlikely to grow in the coming months, which means that tourism receipts in 2020 are expected to be dismal, severely affecting the retail sector.

Beyond the lack of tourism spending to-date, a separate macro note from UOB added that domestic demand may still stay relatively cautious given the global economic uncertainties.

A silver lining can be found in the acceleration of digital adoption by retailers and shoppers, Knight Frank noted, as the circuit breaker and global lockdowns have ushered in a fresh wave

of e-commerce.

However, UOB said that this is not enough. “Some reprieve may be seen given the rise in online sales and the increased demand for consumer necessities in the coming months, although growth in these sectors is likely inadequate to offset the decline in other retail sales clusters,” UOB economist Barnabas Gan said.

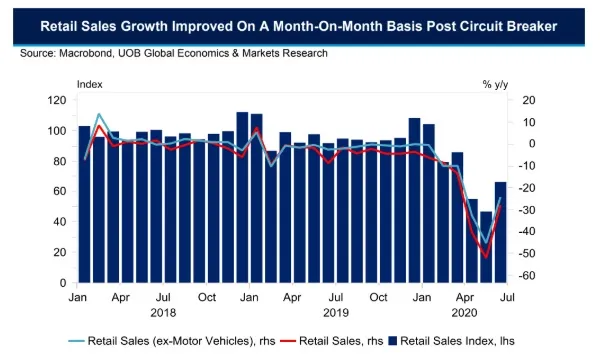

Still, barring a re-introduction of social-distancing measures, the return of domestic consumer demand after the easing of circuit breaker measures should also cushion the rate of contraction on a YoY perspective for the rest of 2020.

UOB projected retail sales to contract by 5% in 2020. Consequently, Knight Frank expects retail rents to decline 10-15% in the coming months of the year, due to recessionary pressures and safe distancing measures to prevent crowds.

Singapore retail sales fell for its 17th straight month at 27.8% YoY in June. The rate of contraction however eased from the record pace of contraction of 52.1% in May. Excluding motor sales, retail sales dropped 24.2%.

Despite the improvements, most retail industries still recorded declines, led by the sales in departmental stores which plummeted 69.5% YoY. This is followed by the sales of wearing apparels & footwear (63.4%), watches & jewellery (53.5%), motor vehicles (47.8%), and food & alcohol (45.7%).

“However, these above-mentioned industries did see a strong pick-up in their month-on-month seasonally adjusted growth rates, suggesting some retail demand has returned post circuit breaker,” Gan added

Advertise

Advertise