Singapore retail sales down 27.8% in June

Department stores saw the largest drop in sales.

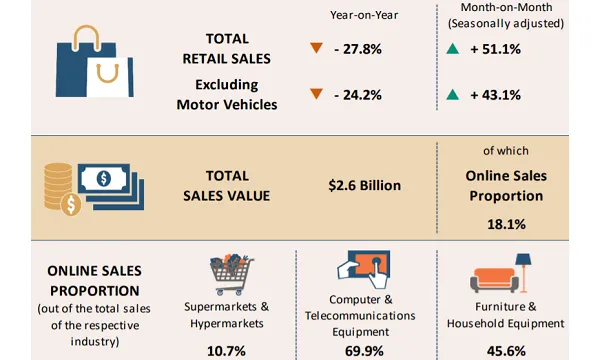

Retail sales in Singapore crashed 27.8% YoY in June, a more relaxed state compared to the 52% YoY decline in May, according to the Department of Statistics (SingStat). Excluding motor vehicles, retail sales fell 24.2%.

On a MoM basis, seasonally adjusted retail sales surged 51.1% in June, or 43.1% excluding motor vehicles. This growth was mainly attributed to the low base in May when physical stores were closed for the entire month during the Circuit Breaker period.

The estimated total retail sales value in June hit $1.9b (S$2.6b), where online retail sales account for 18.1% of it. Online retail sales of the computer and telecommunications equipment, furniture and household equipment, and supermarkets and hypermarkets industries made up 69.9%, 45.6% and 10.7% of the total sales of their respective industry.

Most retail industries recorded declines. Sales of department stores, the wearing apparel and footwear, and watches and jewellery industries fell between 53.5% and 69.5% YoY in the same month.

Conversely, the supermarkets and hypermarkets, computer and telecommunications equipment, and mini-marts and convenience stores industries registered growths in sales of between 8.7% and 43.4%, thanks to continued demand for groceries and computers from work-from-home arrangements.

Meanwhile, sales of food and beverage (F&B) services plunged 43.5% YoY in June, which slightly relaxed compared to the 50.1% decline in May. On a seasonally adjusted basis, sales of F&B services jumped 18.9% MoM in June with the resumption of dine-in services in Phase Two of re-opening.

The total sales value of F&B services in June was estimated at $361.88m (S$496m), where online F&B sales made up 32.7% of it.

Within the F&B services sector, all industries recorded YoY declines. Turnover from restaurants and food caterers sunk 59% and 48.1% YoY respectively in the same month. Similarly, cafes, food courts and other eating places, and fast food outlets recorded lower sales of 32.7% and 20.5% YoY respectively during this period.

Advertise

Advertise