Singaporean consumers remain hesitant in ‘new normal'

Consumer mobility behaviour was still weak after the circuit breaker measures.

Although non-essential retail is reopening, which will aid segments that were hardest hit by the circuit breaker measures, demand-side risks have been emerging amongst consumers globally and will likely impact the spending habits of the Singaporean consumer over the rest of 2020, according to Fitch Solutions.

High-frequency data revealed that since the first set of restrictions were announced in April, consumer mobility behaviour has been significantly affected. Whilst there was an improvement in mobility after 19 June, the phase 2 of re-opening, the figures still remained weak in comparison to a baseline period recorded in January and February.

From 19 June to 5 July, Google Mobility data showed that travel to retail and recreational outlets is down by about 32.7%, compared to the baseline. Although it is improving, mobility is expected to take a few months before returning to normal.

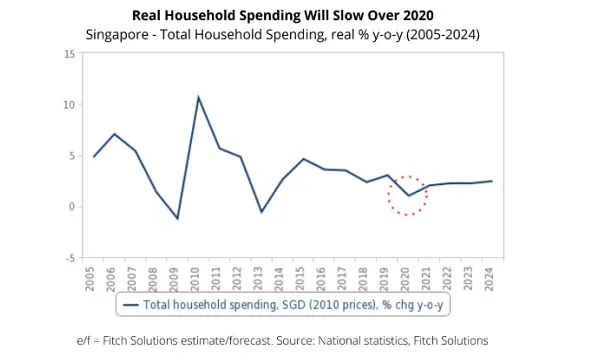

It will likely take time for consumers to adapt to the new normal in the short term, but the easing pandemic measures along with the government’s stimulus plan could mean a recovery in consumer spending. Meanwhile, real household spending is projected to expand 2% YoY in 2021.

Household spending in 2020 is projected to climb by just 1.2% YoY, compared to the 3% growth estimated for 2019. The economy is expected to contract 2.8% in 2020, but because of the nature of the Singaporean economy, with only 37.2% of GDP coming from private final consumption in 2020, household spending is not expected to contract over the year.

On the other hand, unemployment is projected to rise to 2.5% in 2020, from 2.3% in 2019, putting pressure on household spending for the year.

Advertise

Advertise