Webrooming customers spent twice more in Singapore stores

Companies are likely to leverage on this behaviour to offer seamless omnichannel shopping.

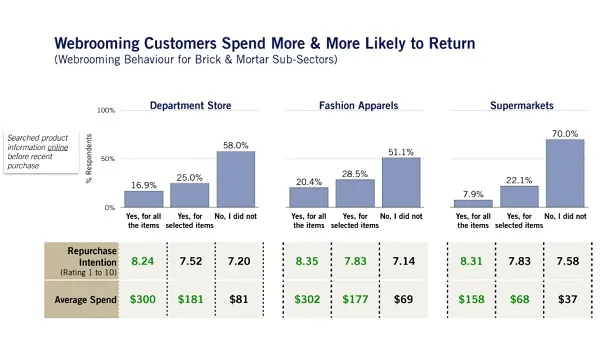

Customers of department stores with webrooming behaviour spent $164.41 (S$229) on average, whereas those that did not do online research spent around $58.15 (S$81), a poll by Singapore Management University (SMU) revealed. This refers to customers who did online research for a product they want to buy before walking in a physical brick-and-mortar store for it.

For fashion apparel buyers, those who webroom all items spent around $216.82 (S$302) on average, whilst those who did not purchased $155.66 (S$216.82). Supermarket buyers who webroom all items spent $113.43 (S$158) versus $26.56 (S$37) by those who did not.

Further, webrooming buyers showed 13.4% higher levels of customer loyalty. They recorded a customer loyalty score of 74.6 points, compared to 65.7 points for those that did not. These respondents were also more likely to repurchase from the retailer.

“Companies can leverage such online webrooming behaviour to offer seamless omnichannel shopping, providing customers with a viable alternative to the physical store experience,” said, SMU’s Institute of Service Excellence (ISE) executive director Neeta Lachmandas.

Lachmandas cited that a shopper looking at a shirt on the web catalogue may also be interested in a matching pair of trousers. “Such complementary features are clear benefits to both the customer and business, and is something a well- designed website or mobile app can provide in a timely and accurate manner,” she added.

The top drivers of loyalty for customers were information about the products and promotions in advertisements for department stores, products being displayed in a visually appealing manner for fashion apparels and return and exchange policies for supermarkets. For e-commerce, the top drivers of loyalty are the variety of products that meet the customers’ needs.

The study interviewed 2,579 customers from the department stores, e-commerce, fashion apparel, and supermarket subsectors in February and March.

Advertise

Advertise