China faces lower consumer spending amidst rising inflation, unemployment

Rise in meat and vegetable prices has driven the inflation rate to 5.2%.

China’s retailers are tipped to suffer from reduced spending in the long term, as rising inflation and unemployment following the lockdown drags on consumers’ disposable incomes, according to a Fitch Solutions report.

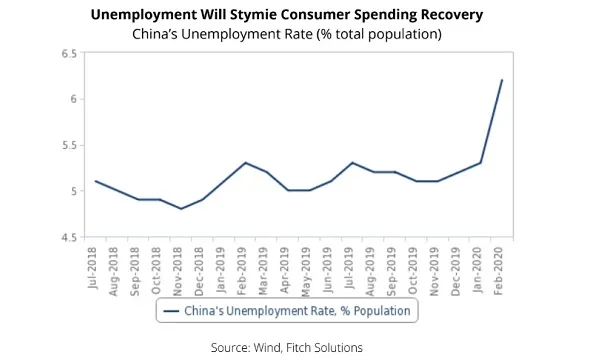

Unemployment in the country has reached a record high of 6.2% in February, from 5.3% in January, with an estimated 4.7 million people having lost their jobs.

“We believe consumer behaviour will move away from solely priority purchasing (food and drink and health products) that was evident during the lockdown, but it will remain essential focused,” the report noted.

Further, the consumer price index (CPI) increase has been largely driven by rising food prices in the past 6 months, as pork prices shot up as a result of the swine flu. The outbreak has aggravated this, with food CPI rising from 17.4% in December 2019 to 21.9% in February.

This was attributed to a surge in demand for meat and vegetables, as consumers purchased more of these items during the outbreak from grocery retailers. With this, meat prices skyrocketed 135.2%, whilst vegetable prices grew 10.9%, driving inflation rate to 5.2%.

“With more money spent on priority food purchases, Chinese consumers will have less money left to spend on all other categories,” the report added.

According to data from the Beijing Enterprise Evaluation Agency for February, retailers have been facing logistical bottlenecks, labour shortages and cash flow pressures in the short term, despite the lifting of lockdowns and lightening of social distancing measures.

Nearly four in five (77%) businesses expressed struggles in procuring the necessary inventory and equipment, as lockdowns forced workers to stay home. On this, over half or 52.2% had less than 30% of their workforce on duty. Further, 30.4% of enterprises surveyed are expecting to have insufficient cash to continue to meet their outgoings for one month.

Advertise

Advertise