Retailers likely to synergise physical and online platforms: study

The on-going rise of online shopping will further build momentum for an omni-channel retail format, according to the 2017 Retail Vision Study by Zebra Technologies.

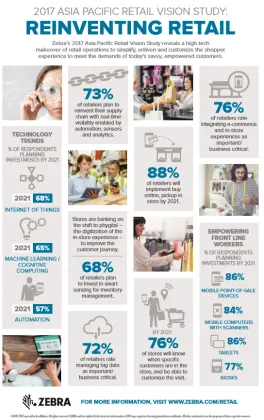

This will challenge retailers to provide unprecedented levels of convenience to drive customer loyalty. In Asia-Pacific, 88% of retailers expect to support a “buy online and pick up in-store” programme within the next four years to further increase omni-channel shopping, according to the study.

By 2021, nearly 76% of retailers in Asia-Pacific will be able to customise the store visit for customers as the majority of them will know when a specific customer is in the store, thanks to technology such as micro-locationing, which allows retailers to capture more data, accuracy and customer insights.

In addition, 72% of retailers in Asia-Pacific rate managing big data as important or business-critical to operations.

Creating a seamless shopper experience is also critical to retailers, as 76% of Asia-Pacific respondents said it is important to integrate e-commerce and in-store experiences. To speed up checkout lines, retailers are planning to invest in mobile devices, kiosks and tablets to increase payment options. In the region, 86% of retailers will deploy mobile point-of-sale (MPOS) devices by 2021, enabling them to scan and accept credit or debit payments anywhere in the store.

The top reasons for shopper dissatisfaction in the survey include inconsistent pricing between stores and the inability to find a desired item and 73% of retailors plan to fix these issues by reinventing their supply chains with real-time visibility enabled by automation, sensors and analytics.

Ryan Goh, Vice-president and General Manager, Asia-Pacific, Zebra Technologies said, the retail industry is experiencing a convergence of the physical and online worlds, as shoppers today are technology-savvy and have high expectations for a digital and connected shopping experience. This creates challenges as well as opportunities for retailers vying for sales on all platforms. He said, “As the omni-channel approach picks up steam, implementing the right visibility technologies from the warehouse to the storefront is instrumental in fulfilling orders, scheduling for fast deliveries, and personalising the experience for different shoppers.”

Advertise

Advertise